The power of compounding, in terms of finance, is the way interest adds to the principal amount of an investment over time, increasing its value. Investors can leverage the power of compounding by utilizing the compound interest principle. Compound interest allows you to earn interest on your principal amount, which is then added back to the original main amount, increasing the amount of interest that could be earned in the subsequent cycle.

Mr Tarun Jain’s current allocation of capital is 85% in debt and 15% in Equity. He mainly invests in the blue-chip companies and uses the equities as collateral. The return on collateral will also increase due to equity participation in it. In this strategy, we are selling a pair of put and call contracts. In this options strategy, Options Traders need to consider how much premium to generate from calls and puts. Traders usually consider the ratio to be equal, but it should not be.

Traders need to compute the trading capital as well. One should not employ the whole capital in one go. According to this strategy, the lots should be divided into 3-6 based on the capital. The lots should be deployed slowly and steadily as the stock market moves. Watch this video to decode how consistently traders can create wealth from the stock market.

Options Traders should not expect unreasonable returns from markets, and such returns cannot be made consistently. Keep a check on high/unreasonable return on your capital, this will keep a check on your greed. Try to focus on strategies that are consistent in profit-making. This will keep traders motivated and contain their fear. The absolute figure of profit is not relevant, and return on capital (%) is an important parameter to be used to analyze your trading performance and assessment of risk undertaken. The options traders also need to keep a check on transaction charges.

_1702035236.webp)

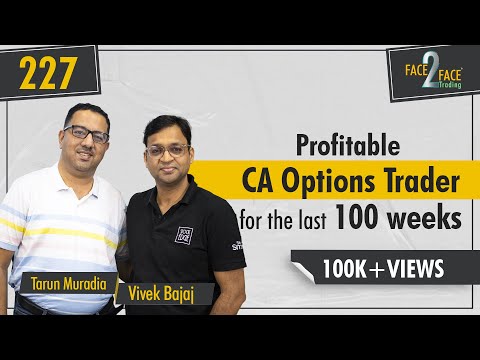

Your Speaker

Tarun Muradia

Your Host

Vivek Bajaj