Succession Planning

Module Units

- 1. Introduction

- 2. What Is The Need To Involve Your Family In Financial Matters?

- 3. Debunking The Myths About Succession Planning

- 4. Tools For Succession Planning

- 5. Nominee

- 6. Nomination vs. Assignment

- 7. Will

- 8. Disadvantages Of Not Writing A Will

- 9. Online Or Offline Will

- 10. Witness And Executor To The Will

- 11. Registration Of Will

- 12. Gifts

- 13. Comparison Between Gift And Will

- 14. HUF (Hindu Undivided Family)

- 15. Properties Or Assets That Can Be Classified As The Assets Of A HUF

- 16. What Happens In Case Of Death Of The Karta?

- 17. Partition Of HUF

- 18. Trusts

- 19. Types Of Trusts

- 20. Practical Matters – Investors

- 21. Mandatory Registration

- 22. Pitfalls Of Forming HUFs

- 23. Comparison Between Will And Trust

- 24. What Your Family Should Know Before Your Death?

- 25. Conclusion

Partition Of HUF

In earlier days, there were so many joint families in India, but as time passed, they all divided into small nuclear families. So, what will happen if a HUF gets divided. We will discuss the consequences of the partition of HUF.

a) Partition of HUF means physical division of property along with the income arising out of the property. Partition of only one of the above mentioned (i.e. property and even the income arising out of it will not be termed as a valid partition under law.

b) Every coparcener has a right to ask for partition, which may be total or partial.

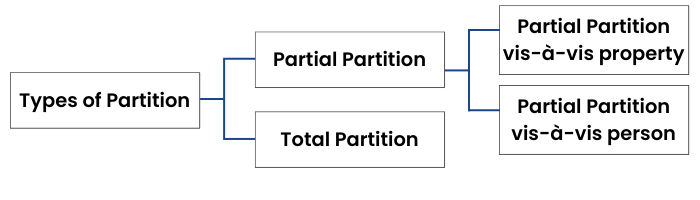

Types of Partition:

a) A partition is total when all properties of the family are divided among the members, and on such a partition, the HUF ceases to exist.

b) Partial partition is of two types: partial partition vis-a-vis property, which means distributing certain property to the members and retaining balance properties with the family; partial partition vis-a-vis person, which implies distributing certain properties to some members of the family, following which such member won't remain part of the family any longer.

c) In partial partition, an HUF continues to be a separate entity. The only change is some of the property/ coparceners don't continue to be part of the family.

d) Female members are entitled to a share equal to that of a son in the event of a partition.

Tax impact on partition of HUF:

a) If the capital or income base of the HUF is large, it may be more viable to make a total partition of the HUF property.

On the partition of the larger HUF each of the married sons will receive the property for and on the behalf of his own smaller HUF. If the smaller HUFs are in the lower tax bracket, it will help save tax in view of spreading income of the larger HUF.

b) Partition of property does not attract capital gains tax.

c) Partial partition is not recognised for tax purposes. Income earned on the property received by a member on a partial partition would be clubbed with the income of HUF as if there's no partition.

Related Modules

Copy the URL

Leaderboard

| # | Name | Score |

|---|

Sign up with Google

Sign up with Google