Succession Planning

Module Units

- 1. Introduction

- 2. What Is The Need To Involve Your Family In Financial Matters?

- 3. Debunking The Myths About Succession Planning

- 4. Tools For Succession Planning

- 5. Nominee

- 6. Nomination vs. Assignment

- 7. Will

- 8. Disadvantages Of Not Writing A Will

- 9. Online Or Offline Will

- 10. Witness And Executor To The Will

- 11. Registration Of Will

- 12. Gifts

- 13. Comparison Between Gift And Will

- 14. HUF (Hindu Undivided Family)

- 15. Properties Or Assets That Can Be Classified As The Assets Of A HUF

- 16. What Happens In Case Of Death Of The Karta?

- 17. Partition Of HUF

- 18. Trusts

- 19. Types Of Trusts

- 20. Practical Matters – Investors

- 21. Mandatory Registration

- 22. Pitfalls Of Forming HUFs

- 23. Comparison Between Will And Trust

- 24. What Your Family Should Know Before Your Death?

- 25. Conclusion

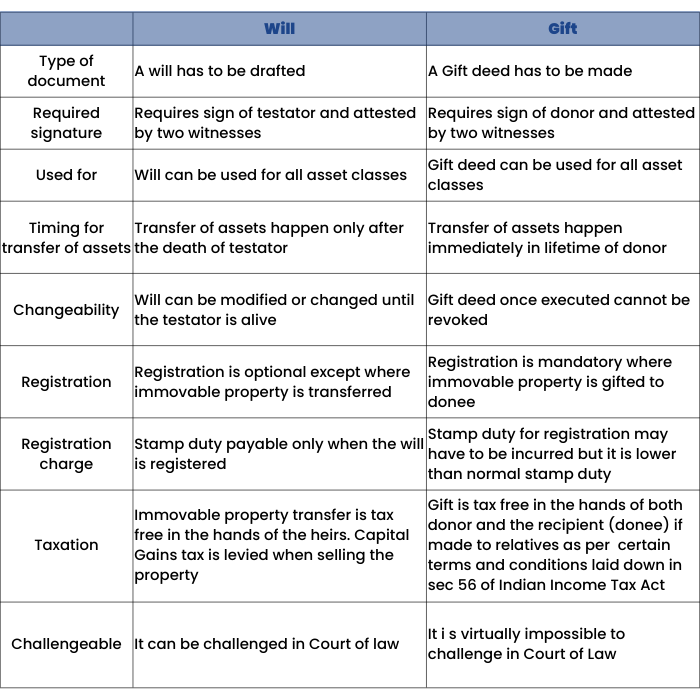

Comparison Between Gift And Will

Earlier, we have discussed both will and gift. So, in this section, let us now compare them breifly:

- The difference between a will and a gift is that a gift has to be executed during the lifetime of the donor unlike in the case of a will.

- Cost of writing a will depends on the complexity of assets and the structure of the succession plan laid out in the will and also on the preparer whereas the cost of writing a gift deed is very minimal but one has to pay stamp duty for registration of immovable property. The stamp duty varies from state to state but in most cases is significantly lower than the normal stamp duty and is payable usually at the circle rate or ready reckoner rates as published.

- A will is relatively easy to write and it can be revoked with a new will or amended through a codicil as many times as one wants till the testator is alive but a gift deed is irrevocable once executed and thus does not allow for any changes even if one changes his mind.

- A will is not required to be registered in court of law (although advisable) and can be challenged in the courts thus prolonging the process of transfer of wealth to the beneficiaries but a gift deed for immovable properties needs to be registered for it.

- Under a gift deed the transfer of assets happens during the life-time of the donor and the transfer happens immediately compared with using a will which is a much longer process.

- The taxation for gift deeds in being tax-free for both the donor and donee when in favour of defined relatives is also beneficial.

Related Modules

Copy the URL

Leaderboard

| # | Name | Score |

|---|

Sign up with Google

Sign up with Google