Introduction

About the book-

This book “Stocks to Riches” focuses on the importance of Behavioral Finance, a branch of finance that combines psychology and numbers. The book starts from the basics such as:

What is an investment? How is it different from speculation? The various techniques of investing then move towards the advanced concepts such as the psychology of investing, decision making, concepts and terms used in Behavioral Finance, mental models, etc. The book gives real-life examples and is a must-read for beginners who want to make wealth through stock market investing.

About the author-

The book is written by Late Shri Parag Parikh. He was a stock broker and the founder of an asset management company, Parag Parikh Financial Advisory Services (PPFAS). Parikh was a long-term investor, a perpetual bull and a disciple of Warren Buffet. The unfortunate event of his death also took place in Omaha, where he had gone to attend the famous Berkshire Hathaway Annual General Meeting and had met with a road accident.

Buy the book-

The book is a great resource to new investors because it provides them with the temperament that is essential for success in the stock market. We highly recommend you to read the entire book. (affiliate link)

What is Investing?

The author states that we all have invested in some way or the other in our life. Yes. Investing is not just about gold and stocks; we all have invested in relationships, education, health, etc. The purpose of investing is different for different people and so are the investment products. Parikh notes that broadly, there are six investment products namely:

The other important things that one needs to know are the terminologies that are widely used in the market. For e.g, buying is often referred to as going long; selling is called going short. If one does this process of going long and short rampantly, then it’s said to be trading. An investor on the other hand saves money and buys for the long term.

Trading is not a bad thing, but one needs to understand whether he/she is trading or investing. For investors, trading creates liquidity in the market and also creates excesses, which ultimately help them to buy at bargains and sell at a good price.

Parekh states that one needs to have an investment plan. The investment plan would differ from person to person according to age, gender, size of family, goals, etc. For example, a young 25-year-old would have higher risk tolerance than a 70-year-old and hence would have more allocation towards risky assets like crypto/stocks, etc.

The author stresses that we should prepare an investment plan in order to meet our goals. For example, if your goal is to purchase a bike in 2 years, maybe stocks would be a better option as the required rate of return is higher, whereas planning for child education is a long-term goal (for a millennial) and requires assured returns as well. Therefore, safer investing tools such as FD, bonds, mutual funds, etc., should be opted for.

As stated earlier, the investment strategy of an individual keeps on changing with age and other factors; the investor can participate in trend-following assets. In this chapter itself, the author has discussed a strategy that he himself used. Let’s say you have 1000 shares of Tata Steel at 100, thereby investing 1 Lakh. Now the stock moves to 125, generating a profit of ₹25000. Now, he suggests you sell stocks worth ₹25000 and invest this amount in another stock/ asset class which is upward trending. This way, you diversify and reduce the risk of losing the entire money.

Investment Strategy: Investment And Speculation

There are two major sources of returns in stock markets:

- Capital gains

- Cash flow from dividends and buybacks.

In order to find companies that can generate good cash flows, look for those with:

- Good fundamentals

- Sustainable business model

- Competitive market position

- Good quality management

A company possessing such attributes can provide shareholders with higher cash flows over the investment period.

Cash flow investing is what the author states are actually for long-term investing. The stock’s value is the present value of all the future dividends. On the other hand, investors who prefer buying stocks for capital gains, i.e. who want to sell the stock on price appreciation are in fact speculators or traders. One should have a long term vision to be an investor and only focus on the cash flows that the company can generate. Warren Buffet has a similar philosophy and buys stocks based on the fundamentals.

The author has given an example of Infosys here. During the tech bubble, Infosys went up from 2,000 in January 1999 to around 12,000 in March 2000. There was no spectacular change in the fundamentals of the company during this period. The stock again went down to 7,000 in September 2000. Again, with no change in fundamentals.

Now, let's see how the market creates exuberance. In FY2000, Infosys reported a revenue of 882 crores and the market was expecting a very high rate of growth of 100% per annum. If we were to compound this even at 85%, it would create a revenue base of 414,000 crores by the end of year 10. Now, comes the valuation part. Infosys was trading at a Price to Sales ratio of 10 during FY2000. An investor buying Infosys at this price, would basically want the valuation multiple to at least remain the same.

Keeping the valuation multiple the same for 10 years would mean a market capitalization of USD 9.2 trillion, higher than the US GDP. That’s insane. No company can be of such high value. Therefore, Parekh was of the view that the so-called investors, who buy a company just for capital appreciation would end up getting disappointed if they buy at such high valuations. However, investors who stayed with the company have been rewarded very nicely.

According to the author, there is nothing wrong with speculation per se, however, it is dangerous when people:

- Do not understand the difference between speculation and investing

- Speculate without proper skills

- Speculate beyond one's capacity to take a loss.

The stock market is all about managing the rewards associated with the risk undertaken. This means that for earning a reward, investors have to take the risk, however, the key term is manageable risk. If we delve deeper into the author’s philosophy, we can see that he is biased towards investing only in good quality stocks with:

- Sustainable business model

- Right price

- Good management quality for the long term

The management of risk can be covered through two aspects. One is position sizing or allocation to the portfolio and the other is by investing in a good company. According to Parikh, if we invest in the right stocks with the right business model and fundamentals, over the long run we are assured of optimum returns.

The author is convinced of the fact that some speculators do make a killing in the stock markets. They are able to sell the stocks at the peak and buy it at the bottom, thus beating the long term CAGR (which investors track and boast about) by a huge margin. However, not everyone can do that.

For investors, on the other hand, the most important aspect is to balance the risk and reward. During the IT boom, people were buying IT stocks with little consideration for the risks. Investors should look for events, such as the Iraq war (2003) or the US recession (2008) when stocks were available at very cheap valuations.

Thus, he concludes that the strategy to play the stock market should be chosen as per one’s mental attitude, discipline, risk-taking ability and patience.

Three Ways of Investing

The author has explained three different methods of investing wherein one is intellectually difficult, second is physically difficult and third is emotionally difficult.

1. The intellectually difficult path

This is the path followed by most popular investors such as Warren Buffet, Peter Lynch, Philip Fisher, etc. These are the investors who take long-term bets and have a vision far beyond the general public. Most of us want to be this, but cannot, the reason being, the intelligence possessed by these individuals to predict cash flows comes from years of hard work and hence is seldom replicable.

2. The physically difficult path

Life is simple, we make it complicated. This method of investing is generally followed by most retail investors. We have CNBC or other business channels running throughout the day, collecting information from wherever we can and what not. This does consume a lot of out time and energy as we give long hours of sittings in front of the price screen. The author believes that by this method, investors just try to showcase they are busy, but in reality, they are not doing anything worthwhile. He advises us to keep our minds fresh, as opportunities come once in a while, and we should be able to take a fresh approach.

3. The economically difficult path

This is the second most desirable path after the intellectually difficult path. The intellectually difficult path concentrates on cash flows; however, on the emotionally difficult path, it’s the patience on a test. Commit yourself to a financial goal and stick to it irrespective of the noise surrounding you. Whether your friend, neighbor or broker tells you to sell your portfolio, don’t listen to them and stick to the financial plan. This would cut your transaction cost, and ultimately over the long term, you are destined to benefit from compounding.

The next four chapters deal with behavioral finance and we will learn how to control our emotions in the market.

Behavioral Finance

There are two schools of thought regarding investor behavior in the markets. One is the Classical Economic Theory, which suggests that markets are efficient and no one can take advantage of its movements. It also assumes that we humans are rational and hence would maximize the gains.

In contrast, Behavioral Economics believes that the markets are inefficient and human beings are not rational.

“Success in investing doesn’t correlate with IQ once you are above the level of 25. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing” ~ Warren Buffet

Behavioral economists believe that humans are not rational & they can definitely prove it. For example, we all must have paid tips to waiters at the restaurant. The full form of TIPS is To Insure Prompt Service. By its very nature, it should be paid at the start in order to ensure that the service is up to the mark. However, it's always paid at the end as a custom. This is not a rational action.

Therefore, the study of behavioral economics helps individuals to exploit the irrationality and inefficiency in the markets. The study bridges the gap between how decisions should be made and how we actually make decisions.

Behavioral finance students and proponents develop financial techniques that take advantage of irrational investor behavior.

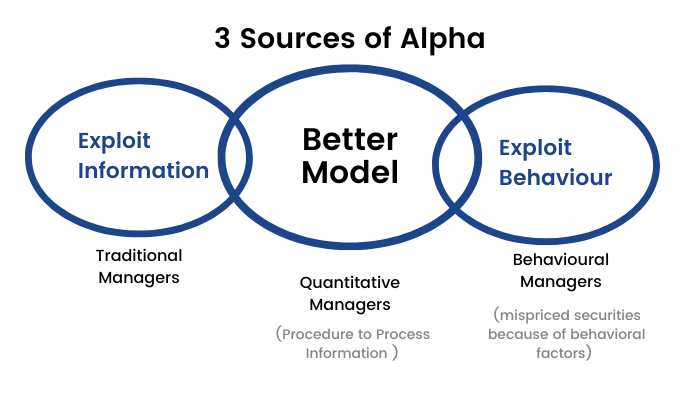

There are three sources of alpha-

- The first is to exploit the information. Traditional managers had access to privy information through their network. This gave them an edge over the general public. With the advent of the internet and the democratization of knowledge added to the SEBI regulations on insider information, this has become more and more difficult to exploit.

- Big data analytics and other machine learning mechanisms have given an edge to investors. Information processing has become faster these days and those with these capabilities can generate higher returns.

- The third source is used by behavioral managers who concentrate on finding mispriced securities due to behavioral factors. Therefore, these are the ones who study behavioral economics and try to take advantage of various anomalies that exist in the markets. For example, it is usually seen that holding companies (For example, HDFC Limited, trades at a discount to the sum of market cap of its holdings in subsidiaries such as HDFC Bank, HDFC Life Insurance, HDFC AMC, etc.) This is an anomaly that needs investor attention.

In the next 3 chapters, we will look at various behavioral anomalies and how to overcome them to become better behavioral managers.

Loss Aversion And Sunk Cost Fallacy

Warren Buffet advises us to be greedy when others are fearful and fearful when others are greedy.

But is it that easy to do?

Imagine the fall seen during the covid-19 outbreak. There was blood on wall street and hence difficult to resist fear. However, if we could understand how greed and fear affect our financial decisions, we might be able to react in a better way.

In this book the author has spoken about a few biases such as:

- Loss Aversion: the fear of making a loss

- Sunk Cost Fallacy: The inability to forget money already spent

- Status Quo Bias: Inability to make new decisions (Decision Paralysis)

- Endowment Bias: Tendency to have affection towards stocks already held in the portfolio and resisting change.

The first two are covered in this chapter while the other 2 in subsequent chapters.

Let's dig deeper into the concept of loss aversion.

Let’s say you are given ₹1000 with two options-

A. Fixed gain of ₹500

B. Flip a coin, if heads – get ₹1000, if tails – get nothing

In a survey, most of the people chose option A.

Let’s take another example,

A. Fixed loss of ₹500

B. Flip a coin, tails you lose ₹1000, heads you lose nothing.

Here, in the survey, the majority chose option B.

If you have studied probability, in both examples, the expected cash flow was the same, ₹500 so you should have been indifferent ideally.

But choosing option B in the second example and option A in the first suggests loss aversion. Since a fixed loss of ₹500 is unbearable, we would take the risky option B, wherein the chance of losing nothing was also there.

Whereas in the first example, sure gain is preferred than bumper gain involving luck/chance.

Loss aversion is there in our mind subconsciously and has the following effects on us.

- Preference for fixed income over equities

- Booking profits early on fear of losing the gain

- Taking more risk than warranted due to instability of mind. Remember, in the stock market, people are loss averse (loss fearing), not risk averse.

- Hold on to losers and sell the winners.

- Tax aversion is the resistance to pay taxes. Subconsciously we want to pay less tax which leads us to generating lower income. The trick is to always count your income net of tax.

The author gives an example here; you own ₹50,000 worth of Wipro which cost ₹25,000 and ₹50,000 worth of TCS which cost you ₹1,00,000. If you urgently need ₹50,000, what would you sell? Majority of us would sell ₹50,000 worth of Wipro due to loss aversion. The correct method as suggested by the author is to sell half of both. This way you complete your money requirement, pay lower taxes and keep a portion of your winning stock in the portfolio as well.

Now, let's delve deeper into another bias called Sunk Cost Fallacy.

Why do people continue to do things they don’t like? It's because they have already invested time or money in it, and leaving it incomplete would mean wastage of time. Think about a course you got enrolled into. In the mid-way you realize that you are not interested in the course. Would it make sense to still complete it? No, because the money you have spent is not going to come back, but the additional time that you are spending could have been utilized in a better manner.

Sunk cost fallacy in case of stock markets is seen when investors keep on averaging a loss-making stock as it goes down. The reason is they don’t want the money already invested to go to waste and hence would put in more money to lower the cost of acquisition. This makes no rational sense and hence the author advises us to come out of this fallacy.

The following methods will help you make better investment decisions.

- Start with an assumption that your appetite for losing money is less than it actually is. This will help you give more time in investment decision making and chances of regret are reduced.

- Diversify across asset classes and within asset classes as well. The best way to not regret loss (loss aversion) is to not have a loss. Diversification is a full proof measure for reducing portfolio risk. Diversify across asset classes like equity, bonds, gold, etc. to earn optimum returns and reduce risks.

- Total portfolio vision. Have a look at the total portfolio value rather than individual stocks whenever a news hits your stocks. When you do this, you are less scared as a well-diversified portfolio seldom crashes as individual stocks.

- Let bygones be bygones. Don’t chase a stock just to lower the cost. Ask yourself each time it urges you to average a loss-making stock, if I did not own a single piece of this stock today, would I still buy it?

- Segregate gains and integrate losses. An interesting concept from Weber's law, which is that two moderately-bad experiences exceed the pain of experiencing both at one time, can be used in the stock market as well. When you want to book a loss, book it in one go, rather than segregating it. On the other hand, when booking profits, be a miser and slowly book it.

- Spend less time in front of the screen. A semi-annual portfolio review is justified.

Decision Paralysis And Endowment Effect

The chapter starts with the status quo bias or the decision paralysis bias. Investors generally face this when they need to sell their loss-making holdings. It is not easy to take such bold moves. The author has given a solution to this under the book’s section, “Taking Decisions”. Parikh states that people don’t take decisions for any one of the following reasons:

- Fear of going wrong

- The possibility of losing

- To avoid looking foolish

- Unwilling to take risk

Some of the behavioral biases like, loss aversion, regret aversion, and egoistic human nature can play a role in delayed decision making.

Similarly, endowment bias comes into play when you refuse to sell something even at a fair price just because you envisage that because the product/stock belongs to you, it’s very valuable. You might not purchase the same product/stock at the price you are quoting. This is called the endowment bias.

The trial and money-back guarantee scheme, something like this, also plays on customers' minds and is an Endowment bias.

Once you get the product home, there is an emotional attachment which increases its perceived value and it's difficult for you to let it go.

Let's now look at some of the remedies suggested by the author-

- Deciding not to decide is also a decision. It is not always necessary to take a buy call on a stock, there is also an option to leave it aside for a while.

- Consider opportunity cost. Whenever you delay a decision in investing, do consider the opportunity lost during that time. The author does not mean that waiting for a stock to fall in order to buy it at the right price is the wrong decision. However, do keep in mind the loss of interest or opportunity during the waiting period.

- Put yourself on autopilot mode. Here the author suggests fixing SIPs and not falling into the trap of timing the market at all. This mechanical way shrugs off the decision paralysis.

- Don't get married to your stock. Remember, you buy stocks for the purpose of beating the market returns. However, if the stock has reached its full potential, take a rational decision and make a switch.

- No free lunches. Like in life, in stock markets, too, everything comes at a price. The offering of free investor conferences and flashy AGMs to attract investors via the endowment effect needs to be understood. Remember, when a product is offered to you for free (recall the trial period offered on Amazon Prime and Netflix), you are the product.

The next chapter deals with mental accounting.

Mental Accounting

The concept of mental accounting was developed by Richard Thaler. The concept underlines the fact that humans allocate separate values to the same sum of money, depending on the source from which it is acquired. Ideally, ₹100 earned either from gambling, lottery, salary, or gift should have the same purchasing power and should not be distinguished. However, investigations show that this is not the case for individuals. People psychologically divide their money into various accounts, assigning each account a unique meaning.

It is also evident when you receive money from your salary; you tend to spend it very cautiously as it's your hard-earned money. Whereas when you receive money as a gift, you tend to spend it lavishly as you treat it without any effort.

Parekh advises the readers to refrain from using credit cards and treat all money equally. On the other hand, he also advises everyone to analyze themselves. If you are a spendthrift (a person who spends a lot of money carelessly), it's better to do mental accounting in order to have financial discipline.

Now how to know that? Parikh shows an interesting test. Let's assume you want to buy an expensive suit. In the first scenario, you won the ₹10,000 lotteries. In the second instance, ₹10,000 was kept and forgotten in your almirah. Which one would you use? If your answer is the first one, i.e. lottery, you are prone to mental accounting.

In order to save yourself from financial distress, you should:

- Always pay cash and never use credit cards. This will make you aware about the cash outflows.

- Be alert about your purchases. For example, if you are buying a car, be very careful of the associated non-essential expenses like car accessories, extended warranty, etc., which might not be that useful.

- Be patient whenever you get a windfall gain. Don’t hurry and spend all of it. Spend a month or two planning for it and this way you are most likely to end up saving.

- Treat all income as earnings and do not treat them separately.

Mental Heuristics

The human mind is not rational. A large part of the economy is run due to this irrationality. Think about why people are consuming alcohol, tobacco, etc. when they know it is injurious to health. Similarly, in businesses, perception is what drives a brand.

Long ago, Pepsi came up with a blind test in which it offered both Coke and Pepsi to people without letting them know which one was what. The results showed that people liked the taste of Pepsi more than Coke. However, Pepsi was still not able to beat Coke in terms of market share. This was because people were not drinking Coke for taste; they liked the feel associated with it.

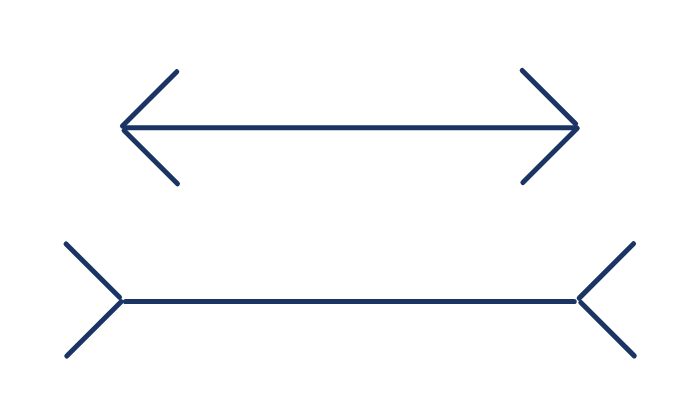

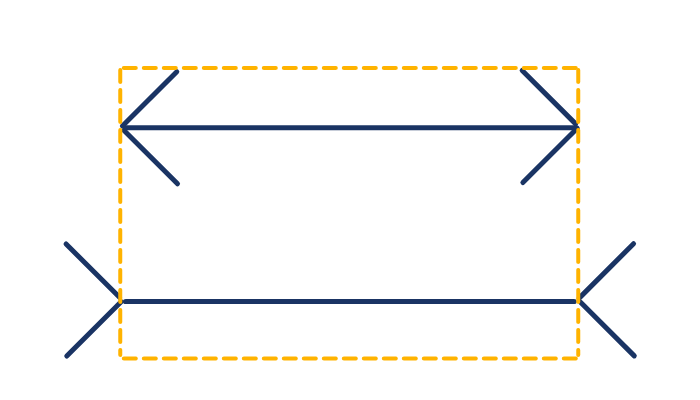

Our brain is trained to process information much faster than required and ends up taking shortcuts. For example, see these two lines.

Which one appears longer? If your answer is the second one, you have fallen into the trap of mental heuristic. Both lines are actually of similar length, but the arrows are put in opposite directions.

In the world of stock markets as well, we take a lot of shortcuts in order to make our decision. Let's say you see a long queue outside Big Bazar one day and thinking the store must be doing well, you go and place a buy order for the stock. When in reality, there might be several reasons for this queue, there might be a technical glitch at the billing counter, or the customers have surrounded in order to return defective items and many more.

There are various types of heuristics (shortcuts) that we, as investors, make.

1. Availability Heuristic

We are more prone to base our decisions on recent or simple to recall events than on other, more complex events. What directs us is the flow of information around us. In bull markets, we generally have all positive news, making investors bullish. Similarly, bear markets have all negativity, creating a fearful investment environment.

2. Representative Heuristic

We often relate the likelihood of one event to the occurrence of another. For example, when Infosys posts good margins, the entire IT sector booms.

3. Saliency Heuristic

We overreact to a one-in-a-million event. An airplane crash is a very rare event. However, we see a spike in travel insurance policies post such an event. In stock markets, we overreact to good quarters and bad quarters, thinking that this is the beginning of a trend.

4. Overconfidence

Parekh advises young investors to respect the markets. Markets are interesting because we cannot understand them. Investment performance is due to the stock’s performance, not necessarily the individual’s ability. The ability is tested over many market cycles.

5. Anchoring and Adjustment

Anchoring bias is when an investor is attached to a particular price point. Let's say a stock touches ₹1500 in the past and is now quoting at ₹1000; investors would believe that it's a bargain because the investor is anchored to the high of ₹1500. However, what if, even at ₹1,000, it was overvalued? Therefore, it is prudent to understand the valuations and fundamentals and not be anchored to a particular price.

6. Herd mentality

History says that investors buy stocks with reasonable due diligence, but selling is based on herd mentality when friends or brokers tell them to exit the stock due to an impending crisis. The fear propagates undue selling. On the other hand, when the stock market is in a bubble, most of the purchases are because the neighbor or friend became rich by investing in the stock market. This, in turn, is herd mentality and is most often followed by a burst.

7. Pattern Recognition

In Pattern recognition, investors extrapolate a good result to be an indicator of the future trend. This might not always be rational, as financial results are a product of both external and internal factors, which are not always guided by a set pattern.

In this chapter, the author has introduced us to the majority of the biases that remained post the four main biases of Loss Aversion, Sunk Cost Fallacy, Decision Paralysis and Endowment effect. From the next chapter onwards, he explains how to invest in the market in order to outperform.

Mutual Funds

Parekh, who himself started a Mutual fund, said that mutual funds have brought in a lot of volatility in the markets. Investment management was a profession but due to the urge to make quick money it has become more of a business. The strategy for most of the mutual funds now is to time the market rather than invest in sustainable good businesses.

An ideal mutual fund should have the following characteristics:

- Long-term investment horizon

- Give prompt exit to investors (within 24 hours)

- The fund managers should be competent with years of experience

- Assisted by strong research analysts

Parekh explained why he is against open-ended mutual funds and stated that long-term vision could not be supplemented with an open-end structure.

Open-ended mutual funds are those which can issue and redeem an unlimited number of units. This means that for one to be a buyer, he can directly claim new units from the asset management company (AMC) rather than waiting for existing unit holders to sell their holdings.

The author explains because of this open-end structure, when the markets start falling, investors exit their holdings of mutual funds. Since the AMC needs money for payout, they sell their portfolio holdings at a lower value in the bear market. This gives momentum to bear markets. On the contrary, for investors who want to buy mutual funds when the market is booming for them, the AMC needs to purchase at higher prices and hence invest at inflated prices.

AMCs also spend on marketing. This provokes them to build investment products that suit the trend in the market. For example, during the IT boom, most of the new funds had IT as their prominent holdings. This gave rise to Herd Mentality.

He strongly states that because of making the mutual fund industry a business rather than a profession, the whole purpose of mutual funds has become outdated. Money management needs to be a profession rather than a business of growing assets under management (AUM).

A Fund manager should be evaluated based on the performance of existing funds rather than how big AUMs he/she is managing. The next anomaly, according to the author, is benchmarking the returns. The benchmark should be absolute returns rather than some index.

The solution to this as per the author is banning the open-end funds. Closed end mutual funds are the best investment tools for retail investors and the investment industry as a whole.

In a close-ended mutual fund, there are a fixed number of units that can be bought and sold. Consider this like a stock where there are a fixed number of shares that are issued in the market. The next set of issues can come only via an IPO. This helps portfolio managers to create the ideal long-term portfolio, as they are now not afraid of selling their holdings in case of a redemption request. If an investor wants redemption, he needs to find a buyer, just like how stocks are traded.

The chapter makes us aware of the various mental heuristics that many of us possess in our investments.

The Stock Market Bubble

The greed and fear among the market participants are what make the stock markets volatile. Let us understand what causes stock market bubbles. The motive of this chapter is to understand the psychology of humans as to why they fear or greed and henceforth take advantage of the same and avoid herd mentality.

You might have observed that the government always tries to comfort the investors and favours booming markets. Booming markets bring in foreign investors (more forex reserves) and also establishes a good image of the government internationally.

Similarly, the regulator SEBI also wants the markets to boom as it is an indication of good corporate governance and an indication that it is doing its job correctly to protect investors' interests. Empirically it's been noticed that booming markets create more volumes in the market and, thereby, more revenue for the government. Similar is the case with the stock market, brokers, banks, AMCs, media, etc., who also love booming markets.

The other market participant which we all have heard about is the operator. Now, operators are the shrewdest of all these market participants. They know the psychology of the markets and hence exploit them to the fullest. The system works in this way – The company (promoter) unofficially appoints an operator. These are given some stock at the current market price and are also given a fixed amount in order to rig the market price of the stock. Now, the operator, who in most cases is the broker, investment banker, etc., influences the stock prices via Circular Trading. Let's understand this.

Join 'The Stock Market Bubble' course and simplify stock trading with our 'Stock Market Made Easy' program today!

Step 1: Create a band of brokers: The first step of rigging the price is creating volumes. The operators are a band of brokers who buy and sell amongst themselves with the motive of creating liquidity in the stock. Since the motive is to take the stock higher, they manage the high price by supporting any selling that comes into the market. All the selling is absorbed by the money received from the promoters and also operator’s own capital. At this stage, the brokers cannot exit. However, they are creating a reinforcing loop in order to seek the attention of market participants.

Step 2: Once the stock gets its feet and the fear of missing out (FOMO) is spread, the retail investors would themselves become the marketing agent of the stock. They would suggest it to their friends and family. Since the stock price is rising, by the heuristic bias, investors gauge that the company might be doing well. At this stage the stock is on an auto pilot mode and the operator’s role is to just keep up the image of the stock. They would pay the media agencies to telecast the stock’s price, give views on the stocks and also promote it to investor groups on telegram, twitter, etc. This bubble starts.

Step 3: Once the stock reaches a certain market cap threshold, the banks start trusting the company and issuing loans against it. This is where big traders and financial institutions enter the stock market, and the bubble is real. The operators can comfortably exit the stock because of liquidity and make good profits. The investors are now at the mercy of the stock price and the liquidity after this, which mostly ends in dismay as the insider information leaks, enquiry on the company is set up, and the regulator takes action on the company.

Now how to avoid this. Well, try to question every market move. In the bull run, question the source of money. In the case of a bear market, question the source of negative information. The purpose of this chapter was to make retail investors aware of how the market functions in real life. Stock prices are a reflection of a lot more than company fundamentals in the short term. Hence caution is warranted.

This chapter might have scared you a bit. However, in the next chapter, Parekh tells us why investing is important and why everyone in his/her own capacity must invest.

Why Must One Invest?

The present generation drives a mortgaged car over a bond-financed higher on a credit card paid fuel.

The desires keep on growing with the growing salary, and hence you will always end up waiting for the pay cheque. Learning to play the game of money is an important step to financial freedom.

First of all, we need to learn how money works.

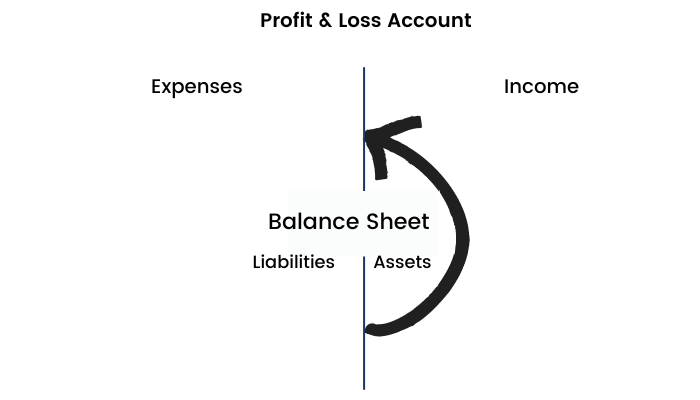

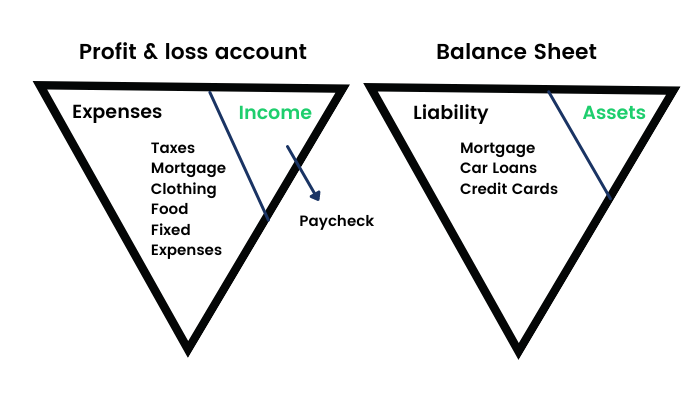

An asset creates income, while a liability creates expense.

When you buy your residential property from home loans, however attractive it may be, always remember it is a liability as it is going to attract expenses like interest, maintenance, taxes, etc.

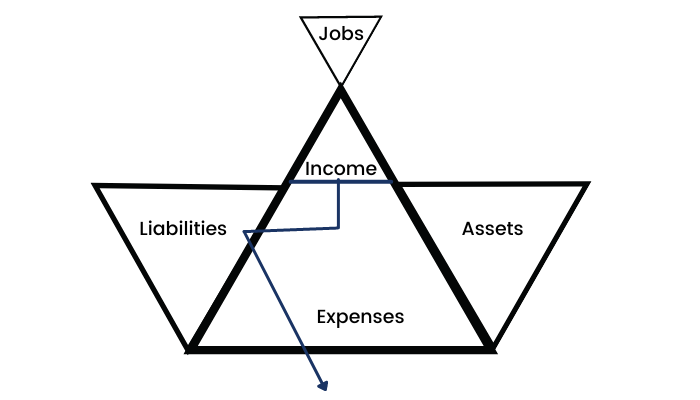

The cash flow cycle of a middle class is, moreover, to settle liabilities (interest/EMIs) from the salary. As the incomes of the middle-class increase, so do their liabilities.

This was the Cashflow patten of a middle class.

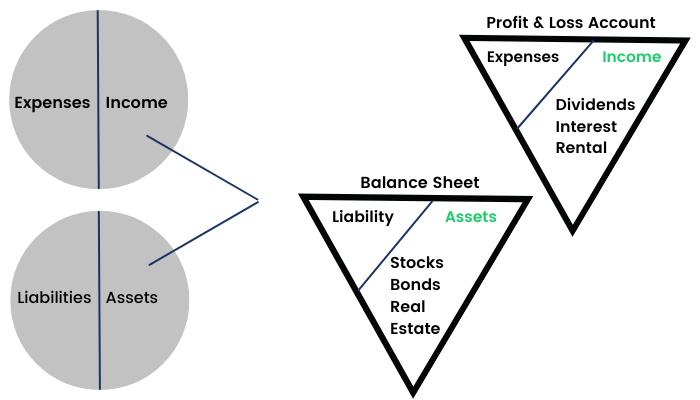

The lack of financial awareness among the middle class separates them from the wealthy. The cash flow is what truly makes a difference. The wealthy are aware of the power of money and use it to their advantage. Their cash flow is consistently favorable.

The rich would invest their money to create assets which will generate income. From the income, they generate more assets. Even if they buy a house on a mortgage, they rent it, and rentals need to be higher than the mortgage. They let money work for them, and they do not create liabilities. Check out the cashflow patten of a rich class-

Here, Parekh advises us to read the book, Rich Dad Poor Dad by Robert Kiyosaki (link) to understand the concept of how to make money work for us.

Why is stock the best form of investment?

We have two options to save money-

- Keep money in a cash or saving account in your working years to save for retirement

- Take some risk and invest money in assets that have a reasonable chance of increasing value

The first option is insensible as inflation erodes the purchasing power. For the second option, the best way to beat inflation is investment in stocks. Stocks reward either through dividends or through share price appreciation. Parekh advises that for someone who doesn’t want to touch the money for 5 years, stocks are the best option. The key is to understand the difference between investment and speculation.

Conclusion

This brings an end to this book. The book is a gold mine for beginners as it equips them with the most important attribute of being successful in the investment game, which is temperament. The book makes us understand various biases that we knowingly or unknowingly commit. The best part is that it also instructs us as to how to deal with them. In the later part of the book, the author advises us to invest in mutual funds that are close-ended and keep ourselves safe from bubbles. Taking risks in stocks (by carefully picking up the best ones) is the best strategy to beat inflation if your holding period is 5 years or more.