Introduction

Life Insurance is something we all avoid in India. Isn't that right? But you will be surprised to know that it is one of the most important things in a person's life. It plays a vital role in financial planning.

In this module, we will learn the A2Z of Life Insurance. So, without any further ado, let us get started:

What is life Insurance?

Insurance is a contract between two parties whereby one party (known as insurer or assurer) agrees to bear the risk of another (known as insured or assured) in exchange for a consideration known as premium and promises to pay a fixed sum of money (called sum assured or cover) to the other party on happening of an uncertain event (death) or after the expiry of a certain period (called tenure of the policy).

The parties to the contract have legal recourse in the event of one of the parties not adhering to the terms of the contract. Insurance is structured to reduce the uncertainty risk and to protect the financial condition of an individual’s family in the case of unexpected loss of life. The insured individual pays a premium to the Life Insurance Company, which accepts the risk the insured is exposed to.

If the insured person will face any losses after this, the company will pay the sum assured to the insured individual.

How does life insurance work?

The underlying concept behind life insurance is the sharing of risks by the pooling of funds. Groups of people having similar risks come together and make a contribution towards a pool and the money so collected is used towards compensating for any losses suffered by members of the pool. When this pool of money is managed by a company it is called life insurance.

Let us consider an example where we have a life insurer, company A.

Company A has insured 5000 people of age 60, with good health status. It is assumed though, that each person is ordinarily exposed to the risk of death.

Suppose the number of people dying in this pool of people per year is 25, and each of the dead person’s families suffers an economic loss of ₹2,00,000.

Therefore, the loss suffered due to deaths is ₹(2,00,000 x 25) = ₹50,00,000.

Suppose each member contributes a premium of ₹1200. Therefore, the total value of all the premiums gotten will become ₹(1200 x 5000) = ₹60,00,000.

25 persons die in a year on an average, but company A pays only ₹2,00,000/- out of the pool to the family members of each of the 25 persons dying in a year.

Therefore, the risk of 25 persons is spread across 5000 people.

Two concepts emerge out of the above example - criteria for insurable Risk and Underwriting. We will cover both concepts going forward in this module. But before that, it is important to understand why life insurance is necessary for financial planning. So, let us discuss this in the next unit.

Why Is Life Insurance Necessary?

Insurance planning is an essential feature of every personal financial plan because of the following reasons:-

The number of nuclear families increasing

Earlier joint families were the norm in Indian society but nowadays an increasing trend of a higher percentage of nuclear families in the total number of households compared to joint families increases the need for life insurance as the dependency ratio increases significantly.

Increase in Debt levels

With the change in the Indian economy in the last 20 years and subsequent growth with it, people’s appetite for loans (home loans, car loans, personal loans, etc) has also grown exponentially. Banks and other entities are ready to give them credit. As the proportion of debt increases, there is a greater need for term insurance.

What happens if you die leaving behind the outstanding home loan or car loan or personal loan. Unlike home loans, other types of loans do not have the feature of term insurance in-built in the premium. So, you need credit-life insurance to take care of the risk of unpaid debt.

Absence of social security increases the need for risk cover

India does not offer a social security system unlike western countries like the USA where the government provides you a minimum allowance to maintain your standard of living if you are unemployed and or do not have anybody else looking after you.

If you live well past your working age (highly possible with the advancement in medical science) then you would need income support. Life insurance can help you in your post-retirement years by providing regular income, so it functions as a useful tool for retirement planning.

Providing financial support to the dependents

Particularly for those with dependents, life insurance is a fundamental element in their comprehensive financial plan. The purchase of life insurance is one of the most effective methods of protecting against the consequences of untimely death.

After a family suffers the loss of a loved one, it usually encounters a stressful readjustment period. In situations like this, proceeds from a life insurance policy (sum assured) can help the heirs/family members to maintain their standard of living.

Also, if the sum assured is a large one, then life insurance can also act as a tool for effective succession planning (passing on the assets to nominees/ legal heirs).

Enables goal-based savings and investment

Insurance is a means to systematically channelize your savings and invest regularly. Your periodic premiums are simply enforced savings and due to this discipline, you are assured of a lump sum amount on maturity. A policy can come in handy at the time of your child’s education or marriage. Not only this, but it can also help in your retirement planning and succession planning.

Tax Benefits

In India, life insurance has been popular due to a number of tax incentives. The Income Tax act provides tax relief for investing in life insurance and investors use this form of investment for tax planning as well.

Your tax can be saved twice on a life insurance policy-once when you pay your premiums and once when you receive maturity benefits. Even during the continuance period, if you receive survival benefits, they are tax-free. So, life insurance policies attract the EEE (exempt, exempt, exempt) regime which is good for you as at all the three-stage, you do not pay any tax.

Any amount that you pay towards life insurance premium for yourself, your spouse, or your children can be included under section 80C deduction of ₹1.50 lakhs in a financial year.

Please note deduction under section 80C is applicable to those individuals who are in the old tax regime.

Who Needs Life Insurance?

In continuation with our discussion on the necessities of life insurance, it is also essential to know who needs a life insurance? Well, the answer is quite simple. Basically, if you have a family to support and you are an income earner, then you need Life Insurance. In view of the economic value of their contribution to the family, housewives too need life insurance cover.

But if you are a single person with no dependents, then don’t make the mistake of thinking that you don’t need life insurance cover. Actually, even a single person requires sufficient life insurance to cover the expenses of personal debts, medical as well as funeral bills. In case you are uncovered, you might pass on the legacy of unpaid expenses to family or relatives.

What are the importance of a proposal and the disclosures made therein?

The disclosures made by you in a proposal form while buying a life insurance policy form the basis for underwriting a policy and therefore any wrong statements or disclosures can lead to rejection of a claim later on causing inconvenience to your heirs / immediate family.

What are special medical reports required to be submitted in Life insurance?

Special medical reports may be necessary for consideration of a risk in case of some proposals, depending upon the age of entry, age at maturity, the sum assured family history, and personal history.

For example, if the proposer is overweight, special reports like Electro Cardiogram, Glucose Tolerance test, etc could be required, while for underweight proposers, X-ray of the chest and lungs with reports could be required.

Definition Of Risk

Previously we have come across the term ‘Risk’ several times in this module. But let us understand: What is the actual meaning of risk in context to life insurance?

The word ‘risk’ can be used in several different contexts. In insurance, risk is applied to certain assets that can be insured, such as a human life, a house, a car, etc.

There is no single definition of risk because of the different contexts in which it can be used. Here are some of the of risk:

- Risk is the chance of damage or loss.

- Risk is doubt concerning the outcome of a situation.

- Risk is something or someone considered to be a potential hazard.

In life insurance the word ‘risk’ is used to describe the possibility of an unfavourable event occurring, for example untimely death or an unforeseen disability.

Insurance provides protection from the following risks -

- Illnesses;

- Accidents;

- Unemployment;

- Living too long after retirement; and

- Premature death.

Insurance cannot prevent the occurrence of these risks, but it can definitely reduce their impact when they occur. Life insurance mainly deals with two risks – premature death and living too long. The other risks relating to human life are mostly covered under non-life insurance. However, life insurance companies offer additional benefits or riders along with life insurance plans to cover the following risks – death or disability due to accidents, illness and unemployment.

(Source : IRDAI study material for IC-33 exam)

Classification Of Risk

In this section, we will study the different classifications of risk.

What is Financial Risk and Pure Risk?

Financial risks are those whose outcome can be measured in monetary terms.

Example – death of family’s income provider, loss of earnings due to disease, retirement

Pure risks are those risks where there is no possibility of making a profit. In pure risks there can be a loss and the best possible outcome is one of breaking even.

With a pure risk the possibility of any benefit occurring as a result of the insured event taking place is nil. This type of risk is associated with those events which are totally out of the control of an individual.

Particular risks are personal or local in their effect. The consequences of these risks occurring affect specific individuals or local communities.

(Source : IRDAI study material for IC-33 exam)

What is Subjective Risk and Acceptable Risk?

The risk perceived by a person based on his mental condition or state of mind is called Subjective Risk. Two persons in the same situation can have a different perception of risk

Regarding uncertainty of an event.

The level of subjective risk which an individual feels comfortable in facing and the size of loss that could be absorbed is called Acceptable Risk. Financial considerations always influence acceptable risk.

What is Risk Management & Risk Analysis?

Risk management is concerned mainly with pure risk and managing them. The process of risk identification and evaluation or measurement is called Risk Analysis.

Risk identification means that until and unless a risk is identified as a threat, it cannot be managed. Risk measurement and or evaluation is necessary to choose the appropriate method or tool of dealing with the risk.

What is Underwriting?

Underwriting is the name given to the procedure of:

- assessing the risk which people bring to the pool;

- deciding whether or not to accept the risk, or how much to accept;

- determining the terms, conditions and scope of the cover to be offered; and

- calculating a suitable premium.

For life insurance, underwriters are responsible for selecting those individuals the insurance company can insure out of those submitting proposals, and also the premium at which it can insure them, based on their risk profile.

As you have seen, the business of insurance is based on the principle of risk sharing. The insurance company carries the risks of the person insured in accordance with the policy terms and conditions. Hence, the underwriters have to be extra careful in choosing the individuals to be insured from the group of proposers and in setting a fair price in line with the risk that each individual presents to the pool. An underwriter who fails to do this can affect the stability of an insurance company’s business.

(Source : IRDAI study material for IC-33 exam)

Insurable Risk

Now that we have understood the concept of risk and its classifications let us discuss the different criteria for insurable risk.

Law of large numbers

Life Insurance companies use the law of large numbers to estimate the losses a certain group of insured persons may have in the future. An actuary (the person who designs insurance products) uses statistics to look at losses that have occurred in the past and forecasts that in the future approximately two out of 100 policyholders will have a claim. Thus, if the company writes 100 life insurance policies, it may expect to pay two claims.

Also, the Insurance companies determine the average cost of claims over time, or loss severity. If the average claim resulted in the company paying ₹1 lakh, then the actuary will forecast that total losses for the upcoming year will be ₹2 lakhs (two claims at ₹1 lakh each).

The law of large numbers states that as the number of policyholders increases, the more confident the insurance company is, its forecasts will prove true. Therefore, insurance companies attempt to acquire a large number of similar risk profile policyholders (called a homogeneous group) who all contribute to a fund which will pay the losses.

An insurance company sets the rates of its premiums according to the number of claims it will expect to pay over the term of the policy.

Loss must be accidental or fortuitous loss

For a risk to be insurable, it should be accidental or of fortuitous nature because insurance is based on chance. You cannot insure an event which is bound to happen. There should be an element of uncertainty. So, a terminally ill person cannot be insured because he is certain to die soon.

A normal healthy person is also certain to die but the timing is uncertain so he/she can be issued a life insurance policy. When death would actually happen, some may die at 30 some at 60 and so on, so the timing is uncertain.

Loss must be definite and measurable

The insurer should be able to measure the loss in definite terms of cause, time, place and amount. There should be no ambiguity as to whether loss has occurred or not. In other words, there should not be any doubt on whether the payment is due under the policy or not.

The cause and time of death can be readily determined in most cases, and if the person is insured, the face amount of the life insurance policy is the amount paid. The losses are fairly predictable and can be measured in monetary terms.

The loss must not be catastrophic

All the insured persons in a homogeneous group should not be exposed to an adverse event and incur losses at the same time.

You must have understood by now that pooling is the essence of insurance. If most or all of the insured persons in a homogeneous group simultaneously incur a loss, then the pooling technique breaks down and becomes unworkable and unviable. Life insurance technique is a viable arrangement as long as losses of few persons are spread over the entire group.

Insurers generally avoid all catastrophic losses. In reality, however, this is impossible, because catastrophic losses periodically result from floods, hurricanes, earthquakes, and other natural disasters. Many life insurance companies protect themselves against catastrophic losses by taking out sufficient reinsurance.

Premium should be economically feasible

The insured persons must be able to pay the premium. The total premium paid during the entire term of the policy must be substantially less than the sum assured (face value) amount of the policy. As the life insurance pool is structured to be sufficiently large, the price charged by the insurer for buying the risk is generally low.

You have seen in the above discussion five criteria which should exist for a risk to be insurable.

Features Of Life Insurance Contracts

The important features of an life insurance contract are:

Rule of insurable interest

For an insurance contract to be valid, the proposer should have insurable interest in the subject matter of insurance. Insurable interest implies that the proposer should benefit financially by the continued existence of the insured life or should be put into financial loss by the loss/damage/death of the subject matter insured.

In life insurance, insurable interest should exist at the time of entering into the contract. Further, in life insurance it is the owner of the policy and not the beneficiary who should possess insurable interest. However, it is quite possible that the owner and the beneficiary are the same though it is not mandatory.

Insurable interest can be for -

- Self;

- Parents;

- Assets;

- Children; and

- Our spouse.

Doctrine of utmost good faith

In all legal contracts, it is essential that the parties to the contract exercise good faith. However, in insurance the emphasis is on utmost good faith which should be exercised by the insured. As the insured alone has complete information about the subject of insurance, he should reveal all the facts to the insurer. In case of breach of this condition the contract becomes void .

What are common clauses in insurance contracts?

The insurance contract contains the following clauses :-

Declaration section where the insured declares that the information provided by him is true to the best of his knowledge.

- The operative clause which describes the insured and the extent of coverage.

- Exclusions under the policy.

- Conditions which need to be fulfilled for the cover to be valid.

Riders and endorsements which are not standard part of the policy but can be covered subject to extra premium. The term rider is used in Life policies. A common rider is accidental death also called double indemnity, whereby if death occurs due to an accident, the claim amount payable is double the face value of the policy.

Life Insurance –Required Cover

What should you look for before deciding to buy a life insurance policy?

Assess your need for buying any life insurance policy – the standard thumb rule is that your life cover should be ten times your annual income. This is so that your family does not suffer financially in case something were to happen to you.

Read the policy brochure and policy wording documents thoroughly and understand the features yourself. Also understand the benefit illustration given by the agent / website but do not trust them blindly, take your time to ask all types of questions and do your own research -

- Understand the type of policy – traditional or market linked

- Availability of guarantee of return in case of traditional policies

- Understand the various fund options in case of market linked policies

- Any charges to be deducted from your premium amount

- Liquidity terms and conditions in the policy – lock-in-period, total term of the policy and any loan availability in case you need money before the policy ends

- Coverage of the policy – this is necessary to know what is covered and do you need to fill up any gaps in your coverage

- Exclusions under the policy – this is necessary to know to what is not covered and to avoid rude surprise (read claim rejections) by life insurance company later

- Details of premium to be paid – premium amount and total premium paying period

- Free-look period – all life insurance companies allow you to return the policy within 15 -30 days If you do not like the policy or you think that the product is not suitable for you

- Impact of premium non-payment

- Revival terms and conditions

- Claim settlement ratio – higher is this ratio, higher is the percentage of claims settled by a company. This ratio is publicly available on IRDAI website and also on the website of some insurance aggregators. Minimum acceptable ratio should be 90% .Any company having higher ratio is generally considered good

- Grievances redressal facility and customer experience reviews

So, you must have understood that the policy charging you the cheapest premium might not be the best one. You sure do not want to land up in a situation where your family faces claim rejection or bad customer service.

It is important to identify not only the right policy but also the right insurance company. So, to identify the right policy there are a few important aspects that need to be considered. Let us discuss this in the next section.

What Should Be The Duration Of Your Policy?

The important aspects of any life insurance policy are:

- The sum assured

- The term or duration of the policy

- The premium amount

Most of the people focus on the sum assured and compare various policies based on that, and finally select a policy based on the premium amount. But in this exercise, the aspect that often gets ignored is the term of the policy.

Most people think they need insurance till they retire – which usually means till the age of 60 years. So, for example, if you are 35 years old, you would buy a policy for 25 years so that it remains in force till you turn 60 (that is, till you retire). This approach is not right.

Think about the number of people who are financially dependent on you currently , and decide for how many years more they would remain dependent on you. Also, think about any financial dependence you might add, and decide for how many years they would remain so. If you have taken some liabilities like a long term loan then for how many years will it continue to be ?

Example 1 : If you are 32 years old and have an earning spouse and a son who is 5 years old, you might only have insurance for 20 years, because by the time you are 52 , your son would be 25 and would be on his own.

Example-2 : If you are 25 and don’t have a child, you might want to take that into consideration and purchase life insurance for a slightly longer duration.

So, there is no fixed answer to the question: What should be the tenure of your life insurance policy? You need to carefully analyze your situation well (read long term goals, needs and any liabilities ) before you commit yourself to a long term policy .

Therefore, the term of your life insurance policy should encompass -

- The years remaining for liabilities to finish;

- The years remaining for dependency of your family members; and

- The years left for you to fulfill your long-term goals.

How Much Cover Is Needed?

Earlier, we have discussed that the sum assured for any life insurance policy should be ten times your annual income. This is a general thumb rule, but theoretically, the amount of life cover depends on different factors that we will discuss in this section.

The amount of life cover depends on the following factors in general:

- Your age

- The amount of Life Insurance coverage you need will depend on many factors such as:

- Your life stage (young and married, married with kids, nearing retirement etc..)

- Number of dependants on your income

- Any outstanding loans (like home loan, car loan, personal loan etc..)

- Present lifestyle of your family

- Amount of money needed for your children’s education

- Amount of money needed for you and your spouse’s post-retirement period

- Amount of your assets or net worth already accumulated by you

- Your capacity to pay the premium

You should seek the help of a certified financial planner to understand your insurance needs and suggest the right type of cover

How to calculate the required life insurance cover through the HLV method?

The human life value (HLV) method for calculation of amount of sum assured for which an individual should assure his life takes into consideration the following aspects:

- Average of present value of the annual future earnings of the individual.

- The number of years the individual is expected to work before he/she retires.

- The expenses that are incurred by the individual on him/herself.

Example: Mr. Amit Kumar on an average may earn an annual income of ₹10,00,000 in future and his expected number of working years is 20. With an annual expenditure of ₹2,00,000 to be incurred on himself (in the form of maintenance expenses, taxes, etc), the human life value of the person will be:

[(10,00,000 — 2,00,000) * 12]= ₹96,00,000

where, 12 is the inflation adjusted rate of return for 20 years

This means that Mr. Amit, should have a life insurance cover of ₹96 lakhs on his life.

Now from this figure, he should deduct the existing sum assured of the policy plus present value of assets (if any) to arrive at the remaining gap which he should fill by buying a new policy.

Note that you don't need insurance if you don't have dependents.

Life insurance is meant to replace your income and provide financial support to your dependents if something unfortunate happens to you.

Life Insurance Plans & Riders

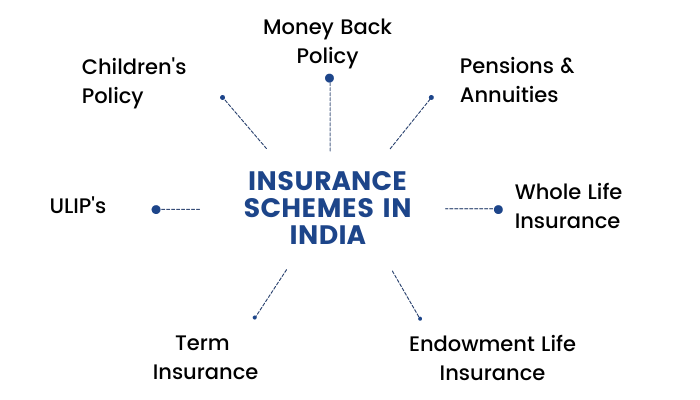

What are the different types of life insurance schemes available in India?

The following flow chart shows a clear description of the different types of policies available in India:

Don't worry if you feel that you have been bombarded with different jargon related to insurance policies. We will be covering each of them in detail going forward in this module.

Term Plan

Firstly, let us start our discussion with the most simple type of life insurance policy, i.e., 'Term Plan.'

What is a term plan and explain its features?

A term policy is a simple pure life insurance which provides a sum assured only in case of the policy holder’s death before the maturity of the policy. Term policies are the purest form of insurance available today. They charge the cheapest premiums as compared to other traditional insurance policies. As the name implies, these policies are issued for a term or a period of time and if the death of the insured occurs during the term of the policy, the insurance company pays the sum assured. If the insured lives beyond the period stated in the policy, no payment is made. The term insurance provides pure death protection and does not have any savings element as some other insurance policies do.

There is no maturity benefit as this type of policy is not an investment policy, your premiums are not being invested anywhere but are being utilized by the life insurance company only to cover mortality risk. These policies are slowly gaining popularity among the Indian population as they understand its advantages like cheaper premium and as a tool for succession planning.

Whole Life Insurance

Secondly, we will understand the concept of ‘Whole Life Insurance’ policy.

What is Whole Life Insurance? Explain its features.

The term 'Whole Life' itself suggests the policy covers as long as the person (insured) lives. The premium is either paid for a limited duration or throughout the lifetime but, the insurance covers the entire life of the policyholder.

The payment under the policy is assured and paid at maturity of the policy which is usually 100 years of age or earlier in the event of death.

These policies are mainly useful for planning one’s estate (succession planning) which is not the priority for most of the Indians.

But these policies are not very popular because they do not meet the expectations and changing needs of many investors, who look at insurance as an investment option.

This type of policy requires premium payment to be made indefinitely and the policyholder may find it difficult to continue the premium payment during his old age.

Endowment Life Insurance

The next type of life insurance we will study here is the 'Endowment' policy.

What is Endowment life Insurance? Explain its features.

These are traditional policies floated by Insurance companies. An endowment policy covers risk for a specified period, at the end of which the sum assured is paid back to the policyholder, along with the bonus accumulated during the term of the policy.

You can choose with bonus option or without bonus option right at the inception of the policy . Premium is higher in the case of a bonus option.

The returns on endowment policies are typically very low – approximately 3% to 5% per annum – and often do not beat inflation. A big reason for low returns from endowment policies is that the premiums are invested in the debt market where gross returns are low.

The sum assured is payable on the death of the assured or after the maturity period of policy whichever occurs first.

This type of policy provides the advantage of security for the family in the event of the assured’s premature death and also facilitates retirement by paying out a lump sum amount at an agreed upon age, should the assured continue to live upto that age. Generally, people try to coincide this with their retirement age of say 60 years.

These types of policies are popular in India as they combine life insurance with investments and although the premium is high, still they thrive due to the people’s desire to get some returns irrespective of the fact whether the policyholders die first or the policy expires first.

Money Back Policy

What is a Money Back Policy? Explain its features.

A variant of Endowment policy is money back policy. These policies are designed to provide sums required as anticipated expenses over a stipulated period of time. Mainly they are marketed by companies as products providing money at major milestones in the life of the assured.

These types of plans work by returning a certain percent of the sum assured to the insured person periodically as survival benefit. Usually, in a 25 year policy, you can expect survival benefit payment at an interval of every 5 years.

The premium is payable for the term chosen by the policyholder.

You can choose with bonus option or without bonus option right at the inception of the policy. Premium is higher in the case of a bonus option.

If the insured survives till the expiry of maturity date of the policy, the survival benefits are deducted from the maturity value,i.e, the balance amount is paid as maturity value.

The life of the policyholder is covered for the full sum assured during the term of the policy irrespective of the survival benefits paid.

Here also the premium is high and these plans return very low,i.e, 3 % to 5 % because they also combine insurance with investments and they invest your premium in the debt market.

Children’s Policy

What is Children’s Policy? Explain its features.

These types of policies are taken out on the life of the children where the parent is the proposer. Through such policies the parent can plan to get funds when the child reaches various stages in life.

These plans carry high premiums and low returns for the policyholders.

These so called children plans are just a separate category aimed at children’s life but in reality they are either a money back policy or endowment policy or even a combination with some other market linked structure.

The only good thing about such plans is that they offer waiver of premiums in case of unfortunate death of the parent/proposer during the term of the policy.

Pension And Annuities

What is an annuity for life insurance?

An annuity is a contract with a life insurance company under which you receive fixed payment on an investment for a lifetime or for a specified number of years. The person who buys the annuity by paying the premium is called the annuitant and the company that provides the annuity benefit is called simply the life insurance company or an annuity provider.

What are different types of annuities?

Annuities can be divided into two types —

- Deferred

- Immediate

In deferred annuity, you save in a systematic manner to build up sufficient funds for retirement. The withdrawals start after the retirement of the investor. This type of annuity represents the accumulation phase during which the annuitant pays premium to the insurer.

In the immediate annuity plan, you invest a lump sum amount as the premium and the insurance company starts paying back annuity immediately. These are suitable for investors who have retired already or are nearing retirement, and want steady income from the accumulated retirement corpus. This type of annuity represents the distribution phase or liquidation phase.

What are different annuity payment options?

There are various annuity payment options that you can opt for. You should select the options that suit your specific needs the best. Some of the popular options are:

- Life annuity: This option pays you annuity for life. The payment stops when you die. Thus, it is suitable for someone who does not have any financial dependents.

- Life annuity with return of purchase price: This option pays you an annuity for life and on death the initial purchase price (premium paid in the beginning) is returned back to the nominee.

- Joint life and last survivor annuity: This option pays annuity throughout your life and on death continues the annuity during the lifetime of the named spouse. Thus, it takes care of the expenses of both partners.

Life annuity increases at a fixed rate: In this option, the annuity amount increases every year at a simple rate. This option may work well for those who have not factored in inflation and need an increasing annuity with each passing year. This option needs a bigger corpus to sustain over the long term.

Need For Pension And Annuities

Now that we have understood the concept of annuity for life insurance and its different types, it is also important to know why it is necessary.

The purpose of annuities is exactly the opposite of life insurance (covers the risk of dying too early), i.e., the risk of living too long (read increasing life expectancy due to advanced medical care facilities). If you live too long then you will be hit by an increase in cost of living and higher medical expenditure.

Therefore, the need for annuities stems from the rise of life expectancy and expenses subsequently.

Retirement benefits like Provident Fund and gratuity are paid in lump sum which are often spent too quickly or not invested wisely with the result that the employee / retiree finds himself without enough regular income support in his post - retirement days. So, pension is an ideal tool of planning for your golden years as the benefit is in the form of regular income at regular intervals

Unit-Linked Insurance Plans (ULIPs)

Lastly, we will understand a unique type of life insurance that combines the benefits of insurance and investment in a single plan known as 'Unit Linked Insurance Plan' (ULIP).

Market Linked Plans - Unit Linked Insurance Plans (ULIPs)

Unit Linked Insurance Policies (ULIPs) are a combination of investment and protection and allow you the flexibility and choice on how your premiums are invested. Herein, the policyholder pays premiums of which a part of the money is invested in markets (this depends on funds chosen) and another part covers mortality charges for providing the life insurance cover. ULIPs therefore combine insurance protection with investments.

Medical underwriting (medical tests) is not necessary to buy a ULIP policy unlike traditional plans. Typically, sum assured = 10 times of the premium paid.

The policy provides you with a choice of funds in which you can invest. You also have the flexibility to switch between different funds during the life of the policy. The value of a ULIP is linked to the prevailing market value of units you get after investing in the fund, which in turn depends on the fund’s performance.

In the event of death or permanent disability, the policy will provide the Sum Assured (to the extent you are covered) so that you can take comfort in knowing that your family is protected from sudden financial loss.

Types Of Unit-Linked Insurance Plans (ULIPs)

Now let us discuss the different types of ULIPs available in the market. They are as follows:

i. Type 1 ULIP

Pays higher of the sum assured or fund value to your nominee in case of death of the policyholder.

ii. Type II ULIP

Pays both the sum assured and fund value to your nominee in case of death of the policyholder. In this case, premium is higher than that Type-1 plan

All types of ULIP plans usually have a lock-in-period of 5 years. So, it is a product meant only for the long term.

What Types of Funds do ULIPs offer?

Most of the life insurance companies offer a wide range of funds to suit one’s investment objectives, risk profile and time horizons. Different funds have different risk profiles. Possible returns also vary from fund to fund. Below given are details of some such funds

Many more combinations and varieties of funds under the garb of different names are offered by life insurance companies in the market today. But basically they are derived from the above mentioned funds.

Investment returns from ULIP may not be guaranteed. In unit linked policies, the investment risk in an investment portfolio is borne by the policyholder. Depending upon the performance of the unit linked fund(s) chosen; the policyholder may achieve gains or losses on his/her investments.

An important point to be noted is that, in ULIPs, the investment risk is borne by the investor. Also, you would do well to note that the past returns of a fund are not necessarily indicative of the future performance of the fund.

Charges, Fees And Deductions In ULIP

ULIPs are ideal for those who are looking for both protection and investment. However, there are certain charges involved in it. So, before buying a ULIP, it is important to know all these charges.

What are the Charges, fees and deductions in a ULIP?

Different insurance companies have varying charge structures in ULIPs.

Herein, you will learn about the different types of fees and charges which are generally deducted from the fund value by extinguishing the units of the investor. Note that the insurers have the right to revise fees and charges over a period of time.

i. Premium Allocation Charge

Premium Allocation Charge is deducted as a fixed percentage from the premium paid in the initial years of the policy. This is charged at a higher rate. The charges include the initial and renewal expenses and intermediary commission expenses. It is a front load charge as it is deducted from your premium paid.

ii. Mortality Charges

This charge is to provide for the insurance coverage under the plan. Mortality charges depend on a number of factors like age, amount of sum assured, etc., and is deducted on a monthly basis.

iii. Policy administration charges

This charge is levied for the administration of the policy and it is deducted on a monthly basis by the cancellation of units from all funds chosen. This charge can be levied at a fixed rate or as a percentage of your premium.

iv. Fund Management Charges

Fund Management Charge is the fee imposed by the insurance company for the management of the various funds in the ULIP. It is levied for the management of the funds and is deducted before arriving at the NAV figure. The maximum charge allowed is 1.35 percent per annum of the fund value and is charged daily. Generally, insurers levy the maximum amount allowed in equity funds, while the charge on non-equity funds is much lower.

v. Partial Withdrawal Charge & Surrender Charge

ULIPs have the option of partial withdrawals & surrender of funds. These withdrawals can be free for up to a certain limit or you can be charged based on your transactions. Both partial withdrawal and surrender of fund or plan are subject to certain terms and conditions.

vi. Switching your funds

The moving of investment between different fund options is called switching. There are options to switch your funds for free up to a certain limit per year. Any further changes might incur a charge of ₹100 - ₹250 per switch. Charges may differ from company to company.

Pradhan Mantri Jyoti Bima Yojna (PMJJBY)

In this section of our module, we will discuss a government-backed Life insurance scheme called the 'Pradhan Mantri Jeevan Jyoti Bima Yojana' (PMJJBY) which was launched in the year 2015.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a Government-of-India-backed pure life insurance scheme which is very affordable. Basically, it is a pure term insurance policy and available for people between the age group of 18- 50 years.

Important features of Pradhan Mantri Jeevan Jyoti Bima Yojana are: -

i. It is a government-of-India-backed pure life insurance scheme which is very affordable

ii. The policy provides life coverage for 1 year.

iii. The policy offers a maximum sum assured of ₹2 lakhs.

iv. As compared to the other term insurance policy the plan offers very low premium rates per year i.e. ₹330. Moreover, the premium rate is equal for all age groups ranging from 18 to 50 years.

v. The insured can renew the policy every year.

vi. According to one’s own choice, the insured can walk out of the scheme at any time and rejoin it in future.

vii. The claim settlement process offered by the policy is very simple and subscriber friendly.

There are certain cases under which the death benefit offered by the policy is terminated:-

i. If the insured person is above 55 years.

ii. The policyholder is insured through different bank accounts.

iii. If the insured has inadequate balance in a savings bank account to keep the insurance in force.

What are the benefits offered by Pradhan Mantri Jeevan Jyoti Bima Yojana?

The following benefits are offered by Pradhan Mantri Jeevan Jyoti Bima Yojana: -

i. Death Benefit

In case of demise of the insured person the PMJJBY provides a death coverage of ₹2,00,000 to the beneficiary of the policy.

ii. Maturity Benefit

As this is a pure term insurance plan, PMJJBY does not offer any maturity or surrender benefit.

iii. Tax Benefit

The premium paid towards the policy is eligible for tax deduction under section 80C of Income Tax Act. In case the insurance holder fails to submit form 15 G/15 H then any life insurance proceeds exceeding ₹1,00,000 will be taxable by 2%.

What Is A Rider?

In this section, let us understand a common term you will come across while buying a life insurance policy: ‘Rider.’

What is a Rider?

Riders are the additional benefits provided by the life insurance companies that give extra benefit by the cost of extra premium (such as critical illness, accidental death, waiver of premium etc.)

By and large combinations of any sort come with limitations or hidden costs. This applies especially to riders offered with life insurance products.

On the positive side, riders are convenient. They expand the amount and type of cover that you can get with your main life insurance policy. The amount of additional insurance you can get via riders depends on the value of the base policy.

On the negative side, the riders get terminated once they are used or when the main policy or base policy terminates or lapses.

Explain the types of Riders.

1. Critical illness or Surgery Rider

Standalone critical illness policies cover a comprehensive list of critical diseases. They impose no restrictions on the extent of cover.

A policyholder who has this cover gets an amount equal to the sum assured if he is diagnosed as having one of the critical illnesses included in the policy contract. For a 40-year old healthy person having a cover of ₹5 lakhs, the cost of such a rider starts from ₹3,000 and can go as high as ₹9,500. In comparison, a standalone critical illness policy (cover for ₹5 lakhs for a 40-year old) starts from ₹1,500 and goes up to ₹7,500.

On the face of it, buying a rider may appear more desirable because of its lower cost. But the standalone policy covers a wider set of critical illnesses. In case of such a policy, you can also get a higher sum assured. Critical illness riders come with a lower limit on sum assured (determined by the value of the base policy). Further, their structure is rigid and there are limitations on renewal of the rider. Therefore, when you look deeper, a standalone product makes more sense despite its higher cost.

2. Accidental death or disability benefit rider

It provides a lump sum cover to the insured for death or disability due to an accident is another rider offered by many insurers. This rider pays the sum assured in case of the insured’s death or total and permanent disability due to an accident. However, the rider may not provide for loss of income due to temporary disablement, which is a risk that is more common. This is a state, which in some instances is worse than death, as it deprives you of the ability to earn.

A standalone personal accident policy from a general insurer offers more comprehensive cover. Not only does this policy cover for death due to accident, partial and total disability, it also covers temporary disability and pays out a weekly compensation of one percent of the sum assured up to a maximum of 104 weeks or two years. This is more than the size of the cover in the policy and is not restricted by the sum assured on the base policy. In the case of a standalone policy, you have the flexibility to hike your cover depending on your income, profession and age.

For instance, a fracture can prevent you from working for weeks. In such a case, this policy pays a weekly allowance that is linked to the insured’s income. Many riders do not offer this.

3. Waiver of premium rider

This is an essential part of child insurance policies. This rider waives off subsequent premiums if the insured or the earning parent dies or is disabled and is unable to continue paying the premiums. If this happens, the insurance company pays the remaining premium.

This is perhaps the only exception where a rider offers great value. This rider waives future premiums if the insured dies or is disabled and is unable to continue paying the premiums. If this happens, the insurance company pays the remaining premiums without limiting or compromising on the benefits. This is by far the most useful rider. Parents buying insurance plans to provide for their child’s financial future should certainly consider this rider.

4. Hospital cash benefit rider

It provides a pre-specified sum of cash for each day that the insured is hospitalised. The maximum number of days of hospitalisation during the entire term for which this rider is available is specified in the policy. But it comes with a number of exclusions hidden in the fine print. One may be better off creating an emergency fund that can be utilised at the time of hospitalisation.

Riders typically cover only a few critical illnesses such as stroke, heart attack, cancer, kidney failure, among others. Also, the policy guidelines restrict the premium payable (and hence the sum assured you can avail) on such a rider. This usually depends on the type of policy and its tenure.

The sum assured offered on these riders cannot exceed the value of the sum assured on the base policy.

Combining a rider with your life insurance cover offers you convenience. However, this may not be what you need. The rider may not help you when you need it most. Use the standalone approach to achieve your insurance needs without compromising on the extent of cover you get. Do not add riders to your policy just because of their low cost. Buy them only if they satisfy your insurance needs.

Premium paid on base policy (including paid for any rider) also is tax deductible on all types of policies –whole life, endowment, money back, term plan or annuities plan and ULIPs also upto the extent of ₹1,50,000/- p.a.

Policyholders Interest Regulations, 2002

Apart from the duty of IRDAI to protect the interest of the policyholders, there is also the Policyholders Interest Regulations Act of 2002, which lays down certain matters that need to be stated in every life insurance policy.

A life insurance policy should clearly state:

- the name of the plan , its terms and conditions;

- whether it is participating in profits or not

- the basis of participation in profits such as cash bonus, deferred bonus, simple or compound reversionary bonus

- the benefits payable and the contingencies upon which these are payable and the other terms and conditions of the insurance contract

- the details of the riders attached to the main policy

- the date of commencement of risk and the date of maturity or date(s) on which the benefits are payable

- the premiums payable, periodicity of payment, grace period allowed for payment of the premium, the date for the last installment of premium, the implication of discontinuing the payment of an installment(s) of premium and also the provisions of a guaranteed surrender value

- the age at entry and whether the same has been admitted

- the policy requirements for (a) conversion of the policy into paid up policy (b)surrender (c) non-forfeiture and (d) revival of lapsed policies

- contingencies excluded from the scope of the cover, both in respect of the main policy and the riders

- the provisions for nomination, assignment and loans on security of the policy and a statement that the rate of interest payable on such loan amount shall be as prescribed by the insurer at the time of taking the loan

- any special clauses or conditions, such as suicide clause etc.

- the address of the insurer to which all communications in respect of the policy shall be sent

- the documents that are normally required to be submitted by a claimant in support of a claim under the policy

i. While forwarding the policy to the insured, the insurer shall inform through the letter forwarding the policy, that the insured has a period of 15 days from the date of receipt of the policy document to review the terms and conditions of the policy and where the insured disagrees to any of those terms or conditions, he has the option to return the policy stating the reasons for his objection, whereby he shall be entitled to a refund of the premium paid, subject only to a deduction of a proportionate risk premium for the period on cover (15 days) and the expenses incurred by the insurer on medical examination of the proposer and stamp duty charges. This 15 day period is known as the free-look period.

ii. In respect of a cover, where premium charged is dependent on age, the insurer shall ensure that the age is verified, as far as possible, before issuance of the policy document. In cases where age has not been admitted by the time the policy is issued, the insurer shall make efforts to obtain proof of age and admit the same as soon as possible.

Rules Regarding Policyholders’ Servicing

An insurer carrying on life insurance business shall at all times, respond within 10 days of the receipt of any communication from its policyholders in all matters, such as:

- recording change of address

- noting a new nomination or change of nomination under a policy

- noting an assignment on the policy

- providing information on the current status of a policy indicating matters, such as, accrued bonus, surrender value and entitlement to a loan

- processing papers and disbursal of a loan on security of policy

- issuance of duplicate policy

- issuance of an endorsement under the policy, noting a change of interest or sum assured or perils insured and guidance on the procedure for registering a claim and early settlement

What is the Claims procedure in respect of a life insurance policy?

A life insurance policy shall state the primary documents which are normally required to be submitted by a claimant in support of a claim.

A life insurance company, upon receiving a claim, shall process the claim without delay. Any queries or requirement of additional documents, to the extent possible, shall be raised all at once and not in a piece-meal manner, within a period of 15 days of the receipt of the claim.

A claim under a life policy shall be paid or be disputed giving all the relevant reasons, within 30 days from the date of receipt of all relevant papers and clarifications required. However, where the circumstances of a claim warrant an investigation in the opinion of the insurance company, it shall initiate and complete such investigation at the earliest.

Subject to the provisions of section 47 of the Act, where a claim is ready for payment but the payment cannot be made due to any reasons of a proper identification of the payee, the life insurer shall hold the amount for the benefit of the payee and such an amount shall earn interest at the rate applicable to a savings bank account with a scheduled bank (effective from 30 days following the submission of all papers and information).

Where there is a delay on the part of the insurer in processing a claim for a reason other than the one covered by sub-regulation, the life insurance company shall pay interest on the claim amount at a rate which is 2% above the bank rate prevalent at the beginning of the financial year in which the claim is reviewed by it.

Grievance Redressal Mechanism

What grievance redressal mechanism is available to life insurance policy holders?

The Consumer Affairs Department of the Insurance Regulatory and Development Authority of India (IRDAI) has introduced the Integrated Grievance Management System (IGMS) which is an online system for registration and tracking of grievances. You must register your grievance first with the insurance company

In case you are not satisfied with its disposal by the company, you may escalate it to IRDAI through IGMS by accessing: https://www.irdai.gov.in/

In case you are not able to access the insurer’s grievance system directly, IGMS also provides you a gateway to register your grievance with the insurer.

Apart from registering your grievance through IGMS website, you have other channels for grievance registration - through e-mail to Consumer Affairs Department, IRDAI or simply call IRDAI Call Centre at Toll Free 155255 through which IRDAI shall, free of cost, register your complaints against insurance companies as well as help track its status.

The Call Centre assists by filling up the complaints form on the basis of the call. Wherever required, it will facilitate the filing of complaints directly with the insurance companies as the first port of call by giving information relating to the address, telephone number, website details, contact number, e-mail id etc of the insurance company.

When a complaint is registered with IRDAI, it facilitates resolution by taking it up with the insurance company. The company is given 15 days time to resolve the complaint. If required, IRDAI carries out investigations and enquiries. Further, wherever applicable, IRDAI advises the complainant to approach the Insurance Ombudsman in terms of the Redressal of Public Grievances Rules, 1998

Must Know Concept And Terms Part 1

Who are the insurance intermediaries?

Intermediaries mean distributors or agents. Traditionally life insurance has been sold by agents which are of 2 types - Individual Agent and Corporate Agents (a firm / company).

But now-a-days you can also buy insurance policies online from the insurer’s website and insurance aggregator websites which will give you the benefit of lower premiums as there is no agent in between. But to do so you must be knowledgeable enough to choose the right policy for you and have to handle all paperwork.

Key Life Insurance Terms

i. Premium

Premium simply means the amount which you need to pay to the insurance company to buy a policy. A single premium policy will require you to pay only one amount. Most of the policies give you the option to pay premium monthly/ quarterly or annually. You have to pay the premium at the said frequency for a fixed number of years depending on the policy terms and condition set at the beginning.

ii. Insurer and Insured

The person in whose name the insurance policy is taken is known as the policy holder or the insured.

The person whom you name as the nominee is the one who will get the insured amount if you die. The nominee is referred to as the beneficiary.

The insurer is the insurance company that offers you the policy.

iii. Sum Assured (SA ) and Maturity Value (MV)

The amount of life insurance cover for a life insurance policy which is guaranteed payable on the death of the policyholder during the policy term is called Sum Assured. This is also called Death Benefit. Death Benefit can be equal to or more than sum assured depending on the type of policy and terms and conditions therein.

The amount to be paid by insurance companies when the policy matures during the lifetime of the policyholder is known as maturity value or maturity benefit.

This will include the sum assured and the bonuses (if this option is chosen at the beginning).

So, maturity value can be equal to or more than sum assured depending on the type of policy and terms and conditions therein.

Example: An Endowment policy

If the policy holder passes away before the policy matures, the beneficiary gets Rs 2,00,000 along with the bonus too (if any).

If he is alive when the policy matures, he will get Rs 2,00,000 as well as any bonuses declared during the tenure of the policy.

Let's say the bonuses amounted to Rs 1,00,000. His maturity value would be Rs 3,00,000 (sum assured + bonuses).

iv. Bonus

Bonus means a benefit for the policyholder in addition to the sum assured. Bonus can be of two types – With profit bonus or a guaranteed bonus.

A with-profit bonus is linked to the profit of the company. If the company makes a profit, it declares a bonus accordingly. The bonus is added to your sum assured and is payable either on maturity of the policy or to your nominee if death occurs before that. This is offered purely at the discretion of the insurer and depends on the profits made in a particular year. It may or may not be declared every year

A guaranteed bonus is a part of the sum assured. It will be paid to you irrespective of the profits of the company.

Must Know Concept And Terms Part 2

This section is in continuation to the must-know concepts and terms for life insurance.

v. Term of the policy

The duration of your policy is known as the term of the policy. In other words, your life is covered for up to a particular time period which is the term of the policy. So, if you paid a premium for a 25 year policy then 25 years is the term of the policy.

vi. Survival Benefits

Survival Benefit means the amount which is payable to policyholders at the end of specified durations. These amounts are fixed and predetermined. This is prevalent usually only in money-back policies.

Example : A Money-back Policy

Now the policy promised to give back a portion of the sum assured (10%, 15%, 20%, 25%) every three years.

After 3 years: ₹20,000

After 6 years: ₹30,000

After 9 years: ₹40,000

After 12 years: ₹50,000

On maturity: ₹60,000. The amount received on maturity is called ‘Maturity Benefit’. This feature is present in all types of policies except for pure term plans.

Should you die during this tenure, your beneficiary will get the entire ₹2,00,000. Irrespective of whether or not you have been paid any amount till date. The amount received is known as Death Benefit.

vii. Surrender Value

If you surrender your policy before completion of its full term , you can get back a portion of the total premiums paid after deducting some charges. This amount of money is called Surrender Value. Surrender Value is applicable only for those policies which are having a savings and investment component. Pure risk covers like term plans do not have any surrender value but traditional plans acquire this value. You will get a portion of your money only if you have paid consecutive premiums for two years (if premium paying term is less than 10 years), and three years (if premium paying term is more than 10 years). If you surrender before this, you do not get back any money. The policy ceases to exist after this payment has been made. It is important to understand that you will lose out on returns if you surrender (stop and withdraw) your policy before time. Different rules and terms and conditions apply for traditional and market-linked plans.

viii. Paid Up Value

When you want to stop paying the premium but still want the policy cover to continue then you have an option that is converting the policy into a paid-up policy. When you do so then the policy cover size will be reduced and will be proportional to the total premiums paid. This sum assured is called paid-up value.

Paid Up Value = Original sum assured x (No of premiums paid/ No of premiums payable)

Example:

Default occurs after 12 yearly premiums are paid

Paid up Value = ₹10,00,000 x (12 / 20 )

The policy acquires the paid up value of ₹6,00,000/-.

This means that the policy is effective as before except that from the date the 13th premium was due, the sum assured is ₹6,00,000/- instead of original ₹10,00,000/-. To this sum assured the bonus already vested (accrued) before the policy lapsed, is also added.

So,if the bonus accrued up to the date of lapse is ₹50,000/-, the total paid up value is ₹(6,00,000 + 50,000) = ₹6,50,000. Note that only those types of policies can be made paid-up which are having a savings element.

Different rules and terms and conditions apply for traditional and market-linked plans.

Practical Matters

Some Must-know Points About an Insurance Account

IRDAI has allowed the facility of holding life / health and general insurance policies in demat form just like you hold shares, bonds and mutual funds online in electronic format. So, you can now keep your E-policy in an E-Insurance account maintained by insurance repositories like CAMSRep, Karvy Rep and avoid the hassles associated with physical policy bonds.

Having an E-Insurance account has many benefits like one-time KYC submission, safety and security, easy premium payments and easy tracking of multiple policies across different insurance companies, A user can have only one such E-Insurance account.

As per the IRDAI (Issuance of e-Insurance Policies) Regulations 2016, electronic insurance is a must for anyone wherein sum assured is ₹10 lakhs or more OR if the annual premium amounts to more than ₹10,000 in life insurance policies.

Different types of returns for life insurance policies

Generally, life insurance companies in India show the IRR (Internal Rate of Return) of their policies, but IRR is annualized return and does not consider the time value of money and as such the return is faulty and does not show the true picture.

Smart investors should know that if they use XIRR (Extended Internal Rate of Return) function in MS-Excel, they come to know the actual real rate of return which will accrue to them at the end of tenure.

XIRR is a more sophisticated method of calculating returns and is almost like compounding returns making it a better choice for calculating policy returns. This is because XIRR uses the actual dates of cash outflow and inflow thus considering time value of money.

Taxation of different policies at different stages

1. Payment stage

i. Tax deductions on Premiums Paid for a Life Insurance Policy under Section 80C

Tax deduction under Section 80C of the Income Tax Act, 1961, allows exemption up to ₹1.5 lakh per annum on premiums paid. Deductions available for premiums paid towards life insurance policies of self, spouse and dependent children.

ii. Life Insurance issued before 31st March 2012

The tax deduction is applicable only for the total premium amounting to a maximum of 20% of the sum assured.

iii. Life Insurance issued on or after 1st April 2012

The tax deduction is applicable only for the total premium amounting to a maximum of 10% of the sum assured.

Accumulation / Payout Stage

i. Tax deductions on Payouts of a Life Insurance Policy under Section 10(10D)

Life insurance payouts (sum assured/coverage) received as a death benefit to the nominee or on maturity as a survival benefit to the insured, including bonuses if any is exempted from tax under Section 10 (10D) of the Income Tax Act, 1961.

Payouts are not tax exempted under the following cases:

- Life Insurance issued on or after 1st April 2003 but on or before 31st March 2012: Payouts received are not tax exempted, except as a death benefit, for any policy issued on or after 1st April 2003 but on or before the 31st March 2012.

- Life Insurance issued on or after 1st April 2012: If life insurance policy is issued on or after 1st April 2012 then the exemption is applicable only if the total premium paid doesn't exceed 10% of the sum assured.

- Maximum limit on Life Insurance premiums: If the total premiums paid during the policy period are more than 20% of the total sum assured received.

Note that monies received on surrender of a traditional policy or a ULIP can be taxable/ tax-free subject to certain conditions.

TDS applicability on payments / bonus recd from life insurance policy

Policy proceeds exempted under section 10(10D) will be given to the insured without TDS (Tax Deduction at Source). Even if these proceeds are taxable as per section 10(10D) but do not exceed Rs 100,000/- then also no TDS is to be deducted by the insurer when making the payment to the insured.

As per section 194DA of the Income Tax Act, 1961, any sum received by an insured Indian resident from an insurer under a life insurance policy shall be subject to TDS @ 2% if the said sum is not exempted under section 10(10D).

Things To Do On Your Life Insurance Policy's Anniversary:

The first insurance policy bought by individuals is usually a compulsive tax saving tool or is a result of word-of-mouth information from close relatives or friends. Seldom, thought is given to serious financial planning, factoring in inflationary pressures or lifecycle changes. Given the lack of awareness, this is not only true in most cases for first-time buyers, but also turns out to be a general trend among the regular customers.

Having said that, there are avenues to rectify or modify decisions by reviewing your need. The best time to analyse one’s needs and financial dynamics revolving around lifestyle is during the policy’s anniversary.

You should follow and implement eight points given below when you are closer to the policy anniversary to be benefitted by the flexibility that comes with insurance products.

i. Lifestyle changes

One should factor in the changes in one’s life and lifestyle while renewing a policy.

If there is marriage on the cards around the policy anniversary, it is important to check if your spouse has life cover. If your spouse is an earning member, you will have to calculate a combined human life value (HLV), the expected lifetime earnings of an individual and change the cover accordingly.

Conversely, if someone is going through a divorce that may reduce the number of dependents, a decrease in cover is advisable. You must also revisit the nomination in both the situations.

The birth of a child is the most joyous phase of one’s life. However, it also brings with it concerns about the future needs of the child. With increasing education costs, it is imperative for parents to build a corpus to plan for key milestones in a child’s life.

Successful professional years translate into higher incomes, which may be a good indication to consider increasing your insurance cover. With the increase in cash flow, you may also need to boost the sum assured of your insurance policy, according to your present net worth.

However, if you lose a job or run into losses, you may want to check if your policy provides flexibility of premium payment at a later date or whether you have an option to stagger the premium payment.

There is always a choice of enhancing one’s cover or investing in policies that factor in inflationary dynamics. For instance, in a term plan, one can hedge against the rising cost of living with an option of increasing the sum assured. One can also add riders, if needed, to their existing policies for higher protection margin.

One may also invest additional amounts to their regular ULIP policy premiums (called top-up). Anytime during the policy term one can invest these additional premiums through top-ups.

ii. Payment options

One should revisit payment options to bring in more flexibility to the policy. One can always rework the various processes of payment such as visiting the branch, online payment and electronic fund transfers.

In your busy schedule while you are juggling with multiple tasks, remembering due dates for policy premium payments can be quite a stress. Switching to an automated ECS facility or even linking to your credit card can be some effective options.

iii. Changes or new tax rules

The Union budget usually has an impact on individuals and their finances. It is important that customers speak to financial planners after every budget announcement to understand their existing portfolio and watch out for the changes in tax norms before making any future purchases.

iv. Rising medical costs

Given that health-care expenditure is rapidly increasing every year, families may want to reconsider or rework their health cover according to lifestyle changes and expenses incurred. This is a good time to add to the health cover if it does not match the changing cost scenario.

In the case where a dependant has met with a serious ailment which has strong chances of recurrence, options to increase the medical cover may become limited. In situations like these, one can consider buying a unit-linked health plan which may not require any medical tests and will hedge against future expenses.

v. Loan plans

Plan your partial withdrawals and loans in advance. Usually most insurance companies offer products that provide customers an option to get a loan on their policies. One should decide the minimum and maximum withdrawal limit, corpus goals and interest rates offered by the company.

vi. Service experience

The tools and services available now can help customers manage their policies more comfortably. You should evaluate the need for various services and tools introduced by your insurance company while renewing your policy.

vii. Keeping tabs

Before purchasing an insurance plan, one must study the service efficiencies of a company, especially in the areas of claims settlement or investment performance.

Even on an ongoing basis, it would be a good practice to review information on important service parameters of your insurance company to understand the overall efficacy. This will help when it is time to reap the benefit or when a bereaved applies for the cover/claim.

viii. Inform the nominee

Keep your nominees informed about your financial decisions. All precautions you have taken to fill up the proposal form can be meaningless if you fail to inform your nominees about the whereabouts of your policy documents. Some people refrain from telling the nominees about the policy either out of a feeling of insecurity or ignorance.

When Should You Exit A Life Insurance Policy You Don’t Need Anymore?

Have you felt at times that the life insurance policy you bought at the behest of the agent, is not suitable for your needs? Is it that often you end up buying a life insurance policy at the end of the financial year just to save more tax? And what is the result - you do save some tax, but also end up with a policy that you may not need. The good news is that you need not be stuck with the policy through its entire course.

Except for term plans, almost all insurance policies have some type of exit option that can be exercised at a cost.

You can find the details below as to when and how you can exit from life insurance policies:

i. Exiting in the initial phase of the policy - The Free look period

As per IRDAI rules, all the policies have a free look period of 15 days from the date of receipt of the policy.

Within this period, policy holders can return the policy to the insurance company and request for a premium return. He gets the refund after deduction towards proportionate risk premium for the period on cover, medical tests, stamp duty and service charges. These charges are not refunded.

ii. Letting the policy lapse

The easiest way to exit a policy during the initial years is to let the policy lapse if you have missed the free look period. Stop paying your premiums and your policy lapses. You will not receive anything if the policy lapses and all your premiums would be lost. Exit options beyond the free look period are not offered by term plans.

iii. Exiting after two / three years

After completion of two / three years, insurance companies offer the following exit options :

a. Surrendering the policy

b. Letting the policy become paid up

iv. Timing the market

After the lock-in-period of 5 years is over, then you can exit your ULIP policy (unit linked insurance plan). Your units will be redeemed at the prevailing NAV on the date of redemption. Before a 5 years lock-in-period if you stop paying the premium and convert the policy into paid-up then the existing fund value will be transferred to a discontinuance fund earning 3.5 % return only, so this option is not advisable.

When You Should Hold On To The Policy?

Insurance policies are beneficial when held for long term specially ULIPs. As the policy progresses, the benefits keep on increasing. So if you have already passed the first few years then it may be wise to hold on.

If you think to exit from your insurance policy and want to reinvest the proceeds elsewhere then check that the new investment option should earn better returns and also should have the potential to recover the losses incurred in exiting the insurance policy.

What documents are generally required to be submitted in case of death of life assured while the policy is in force?

Generally, basic documents required are death certificate, claim form and policy bond. Among other documents are medical attendant’s certificate, hospital certificate, employer’s certificate, police investigation report, post-mortem report etc. These may be asked depending upon case to case.

The claim requirements are usually outlined in the policy bond and the insurer’s website.

1. What is meant by settlement options?

A settlement is the way in which the life insurance policy proceeds are paid out to you, the policyholder. The terms and conditions are given in advance in the policy document at the beginning of the contract.

For example, a policy may offer settlement options like paying a lump-sum or regular monthly flow of income for a certain number of years after completion of maturity period.

2. What are the requirements to be submitted in case of a Maturity Claim?

Usually the policyholder receives the intimation from the insurance company along with a discharge voucher at least 2 months in advance of the maturity date of policy. This intimation notice informs the claim amount payable.

Also, the intimation mentions that the policyholder has to submit the original policy bond and discharge voucher duly filled and signed by him along with signature of witnesses. You also need to submit your bank account details like a cancelled cheque for getting the claim money.

Conclusion

So, we have now completed our journey of learning Life Insurance. Hope you found this module knowledgeable and interesting. You might have been astonished to know that there are so many different types of life insurance policies available in India. However, we have discussed each of them in a detailed manner. At the time of buying a life insurance policy for you or your family, the learnings of this module will definitely come in handy. If you like reading this module, share it with your friends and family. Nevertheless, we have curated more interesting modules on different areas of finance. Hope you will find them interesting as well.

Happy learning!!