Introduction

Credit cards are slowly becoming an essential part of our lives. From shopping online in just a few minutes to buying medicines – credit cards have eased our lives in many ways.

In this module, we will cover the basic things about credit cards that you should know and also answer some common questions and other useful information that will make your credit card user experience smoother and hassle-free.

What are credit cards?

A credit card is a thin plastic card issued by a financial institution. The card has a pre-approved limit which you can use for purchases. Some credit cards also have a pre-approved cash limit which helps you to withdraw cash through any ATM. The pre-approved limit varies from one person to another and is solely dependent on a person’s credit score and credit history.

The card can be swiped at physical shops or used online for making purchases. Every month, the card issuer issues a bill and the user needs to make the payment. We have discussed more about this in the section ‘how to use credit cards’.

Difference between credit and debit cards

People often confuse debit cards and credit cards since they are both plastic cards and both are issued by financial institutions. A debit card is linked to your savings and current account and allows usage of the funds in the account. A credit card, on the other hand, is a credit limit issued by the bank, where you can use the money first and pay later. Usage of a credit card involves payment of interest, while usage of a debit card does not.

Credit Cards:

- Line of credit that can be accessed with the card

- Interest have to paid if payment is not done within 30 days

- Can be used for online purchases and at physical shops

- Over-usage can lead to going out of budget and falling into debt

- Have to use PIN or OTP for every transaction

Debit Cards:

- Tied to your savings or current accounts

- Can be used for online purchases and at physical shops

- Can help someone remain in the monthly budget

- Have to use a PIN for every transaction

Components of a credit card

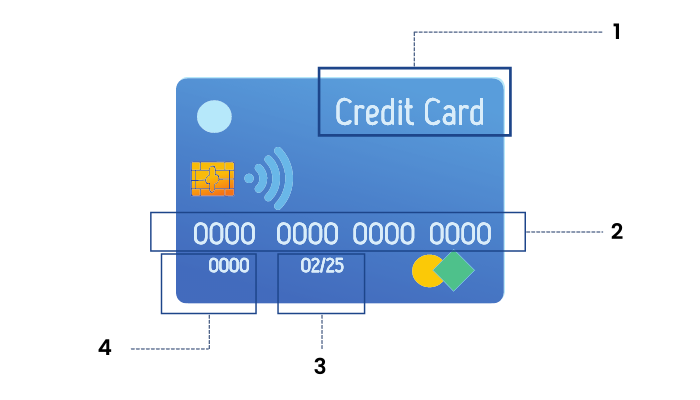

Now let us see what a credit card looks like. The picture given below represents the front side of the credit card. The four elements as shown here are:

1. The name of the bank/NBFC which has issued the credit card.

2. This is your credit card number

3. This shows the month and year when your credit card expires in DD/MM format

4. This will reflect your name

Now let us see the back of a credit card. There are 3 important sections here:

5. This is the magnetic strip of your credit card. In case you swipe the credit card at a shop, this magnetic strip is from where your card information is taken. Please ensure that this portion is not spoilt when you store the credit card.

6. This is the section for the card holder’s signature. The card is not valid unless it is signed.

7. These 3 digits are called CVV – card verification value. This is the security code of your card and is extremely important. Whenever you make an online transaction, you will have to quote this number. Never share this code with anyone.

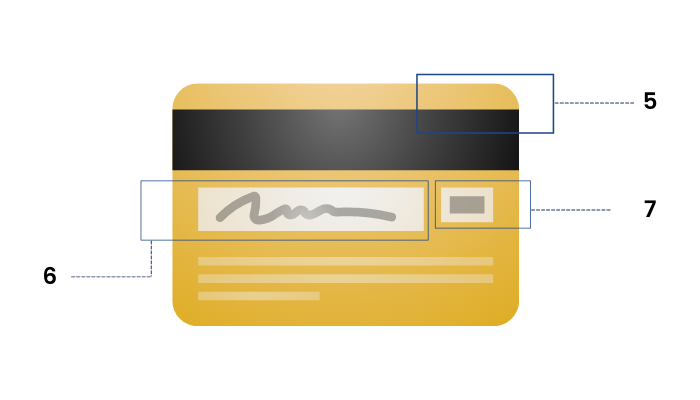

Advantages and disadvantages of credit cards:

How Do Credit Cards Work?

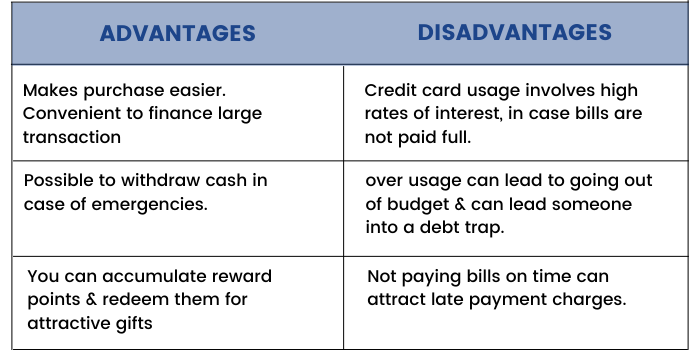

Understanding how credit cards work will help us understand the various aspects of credit cards.

Simply speaking, when you use a credit card for a transaction (say online shopping), you do not pay anything at that point in time. Instead, the card issuing bank or non-banking financial institution (NBFC) pays on your behalf. You can use the credit card as much as you want till you exhaust your approved limit.

At the end of 30 days (every card has a credit cycle….more about this later in this section),the bank or NBFC will send you a credit card bill. This is the time when you have to make the payment. You have the option of paying this bill in full or make a part payment. In case you pay it in full, you don’t have to pay any charges. However, if you make a part payment, interest will be levied on the remaining amount and added to your next monthly bill.

Let’s see a quick snapshot of what we just discussed:

Credit card statement

Let’s first see how a credit card statement looks and then understand its components one by one:

1. Statement date: The date on which the statement has been issued. This remains the same every month. For example, in the given example, the statement has been issued on October 28, 2020. This means that for this credit card, the statement is issued on the 28th of each month.

This brings us to the concept of billing cycle which is the 30 day period for which your credit card statement is issued. For the above example, the billing cycle of the card in the above example is from the 29th of month 1 to the 28th of month 2.

2. Payment due date: This is the date by which the credit card payment has to be made. In the case at least the minimum balance amount due is not paid by the due date, a late payment charge is levied (discussed in the next section). For example, in the above example, in case the minimum payment amount of ₹ 200 is not paid by November 15, 2020, a late payment charge will be levied.

3. Total amount due: This is the total amount that you need to pay back to the bank/NBFC for the usage of the credit card in the previous 30 days. If you pay this amount in full, you will not be charged any interest. Any part payment will attract interest charges on the remaining amount.

4. Minimum amount due: This is the minimum amount that you have to pay to the bank/NBFC. Usually, this is 5% of the total amount due. Non-payment of minimum amount will not only attract late payment charges but may also lead to severe actions from the lender’s side such as card blockage, calls from the bank/NBFC or more severe actions as deemed fit by the issuing authority.

5. Previous balance: This is the total billed amount in the previous statement (i.e. bill generated on September 28, 2020.

6. Purchases/charges: These are all the transactions done during the billing month, where you have used the credit limit.

7. Cash advances: In case you have withdrawn any cash from your credit card, it will appear here.

8. Payment/credits: This section contains details of all payments you have made during the billing cycle. Hence, your previous payment will reflect in this segment. Also, in case you have received any other credits such as cashback or refund of any payment, that will also show here.

9. Credit limit: Every credit card has a credit limit, which is the maximum amount of money you can use. As mentioned earlier, this is determined based on a person’s credit history and repayment capacity.

10. Available credit: This is the unused amount of credit in the card. For example, if your total credit limit is ₹ 100,000 and you have used ₹ 40,000, then the available credit limit in your card is ₹ 60,000.

11. Cash limit: Some credit cards may allow withdrawing cash from the credit card. This limit is known as the cash limit. However, remember, this advance entails very high-interest charges and hence should only be used in the times of utter necessity.

12. Available cash: Similar to the available credit card limit, this is the unused amount of cash limit in your credit card.

Other common terms related to credit cards:

Now, let us discuss some terms you will commonly hear with regards to credit cards:

Balance transfer: Sometimes, people transfer the outstanding balance from card A to card B. This process is known as a balance transfer. The primary reason for doing this is that card B may have a lesser interest rate than card A or may offer an EMI option to pay off the bill faster. Of course, other benefits may also be there. However, please note that either card A or card B may charge a fee for such balance transfer (commonly known as balance transfer fee). Hence, find out about it before you make a balance transfer.

EMI: While making transactions of a certain amount and above, you will be given the option to pay in full or convert the payment into monthly EMIs. You can choose to convert the entire payment into EMIs for 9-month, 6-month, 9-month and so on. Sometimes, banks offer conversion into EMIs with no interest. However, you may still be charged a processing fee. This is a convenient method to finance your expenses.

Every lender has its own process of converting to EMIs. Usually this can be done online through the lender website. You may also call customer care and opt for EMIs.

OTP: OTP or one-time password is a code that is SMSed/emailed to you while using your credit card online. This is a security code which is sent to your registered mobile number or email id or both. Ensure that you do not share this with anyone else. This code also ensures that your credit card is not being used by any unauthorized person. Until and unless you input the OTP, an online transaction will not be successful.

Ready to master finance from A to Z? Enroll now and unlock the secrets of credit cards and more!

Credit Card Interest And Other Charges

Every credit card has interest charges, which is the main source of earning from the credit card for the bank/NBFC.

To put simply, the general formula of interest calculation in a credit card is:

(Number of days from the date the transaction is made X entire outstanding amount X interest rate per month X 12 months)

But there are some concepts to learn. So let’s understand them through an example of a transaction on a credit card:

Transaction date: November 1, 2020

Transaction amount: ₹ 10,000

Statement date: November 10, 2020

Payment due date: November 28, 2020

Total amount due: ₹ 10,000

Minimum amount due: ₹ 500

Monthly interest on unpaid credit card bill: 3.5%

Scenario 1: Let us assume that in the first scenario, the bill is paid in full on the due date: November 28, 2020

No interest will be charged on the card.

Scenario 2: Let us assume that the credit card holder makes a partial payment of ₹ 5000 on the due date: November 28, 2020

The next statement will be generated on December 10, 2020. For the ease of calculation, let us assume that this transaction of ₹ 10,000 is the only transaction on this credit card and no transaction has been made on the credit card after November 28, 2020.

The total interest charged in the statement generated on December 10, 2020 will be calculated in 2 parts:

1. Interest levied for 28 days (from November 1 to November 28) on ₹ 10,000 = 28X10,000X3.5X12/365 = ₹ 322.19

2. Interest levied for 12 days (from November 29 and December 10) on ₹ 5,000 = 12X5,000X3.5X12/365 = ₹ 69.04

Thus the total interest charged in statement generated on December 10 = ₹ 322.19 + ₹ 69.04 = ₹ 391.23

Please note that if the payment is made in full, no interest is charged. However, in the case of partial payment (such as ₹ 5,000 in scenario 2), interest will be charged on the full amount until the payment is made and then on the remaining amount after the payment.

Sometimes, banks/NBFCs may extend the interest free period on certain high value cards, to reward high networth individuals. For example, Citibank offers an interest free period up to 53 days for certain types of cards.

Other charges associated with credit cards

Well, interest is not the only charge that you pay on a credit card, there will be other charges as well. Let’s see some of them:

- Annual fee: Sometimes credit cards may have annual fees which are charged by the financial institution for issuing the card. It is charged only once a year. Of course, free cards are also available, but they may not have good features. Sometimes, no annual fee is charged in the first year, and it is levied only from second year onwards. It is a good idea to check this annual fee while applying for the card.

- Late payment fee: Every credit card bill will have a date by which the payment has to be made. In case if the payment is missed, the bank/NBFC will charge a late payment fee. Please note that this applies only if the payment is missed completely. In case you have paid at least the minimum balance by the payment due date, late payment fee will not be charged. Missing a payment should be avoided, not only to avert this fee but also to add a black mark in your credit history.

- Cash advance fee: As mentioned earlier, most credit cards have a cash limit, which you can use to withdraw cash through an ATM. This is known as a cash advance or cash withdrawal. However, banks will charge interest on the cash withdrawn which is known as a cash advance fee. This interest is charged right from the day the advance is taken and hence, it doesn’t involve any interest-free period. Cash advance fee may or may not be the same as the credit limit interest. The rate will vary from bank to bank. Hence, it is a good idea to check the fee before withdrawing cash from the credit card. Please remember, withdrawing cash from credit cards should be done only in times of emergencies. It is not a good idea to make it a habit, since the interest charged is pretty high.

- Over-limit fee: In case the credit limit in a credit card is exhausted and it is used for an extra amount, banks/NBFCs will charge an over-limit fee. This fee can be different for different banks/NBFCs, however, they generally start from ₹ 500.

- Foreign currency usage fee: One of the main benefits of credit cards is the ability to use them across the world without having to carry traveller’s cheques or foreign currencies. This feature can be very helpful especially during emergencies. However, this benefit does not come without a fee. Lenders charge a fee for every usage of credit cards abroad.

- GST: GST is charged on all credit card transactions, interest payment, annual fee and processing fee. At present this is charged at the rate of 18%.

Additional Benefits Of Credit Cards

Apart from the ability to make purchases and withdraw cash, most credit cards offer additional features. Every bank/NBFC has a wide variety of credit cards, each having unique features. You can evaluate the offers and understand which one works best for you.

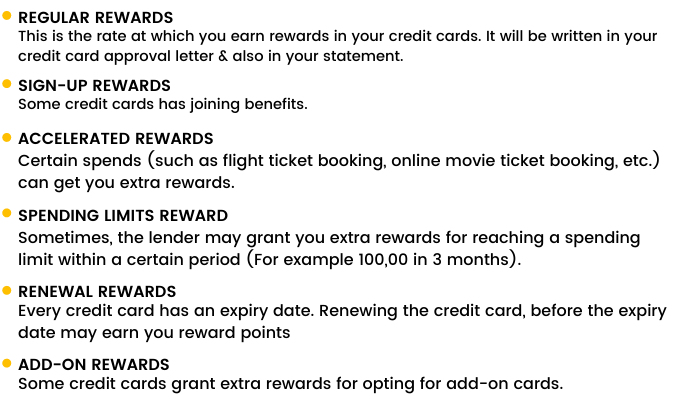

Reward points

Every transaction you make earns you a reward point, the rate of which may vary from one credit card to another. For example, HDFC Diners Club Black Credit Card gets 5 reward points for every ₹ 150 spent while HDFC Freedom Credit Card gets 1 reward point for every ₹ 150 spent.

These reward points accumulate and can be redeemed later for a number of things such as vouchers, electronic products, air miles and more!

Reward points can be earned on a credit card in a variety of ways. Let us see some common ones:

Redeeming the reward points

Once a sufficient quantity of reward points have accumulated in your credit card, you would want to redeem the reward points. Every bank/NBFC has its own rewards catalogue, from which you can choose what you like. Every bank/NBFC will also have its own redemption procedure. However, most of them offer online redemption. In case you opt for an online voucher, it will be delivered to your email id. In case you opt for something else, it will be delivered to your mailing address.

Some of the most common redemption options available for reward point redemption are:

Vouchers/Gift vouchers: You can redeem the reward points for vouchers of prominent retailers and businesses. You can also opt for gift vouchers, which you can use for gifting.

Merchandise: Most reward catalogues have a wide variety of products such as electronic gadgets, beauty products, clothes, home essentials and much more.

Cashback: Sometimes, you may redeem your reward points for cash back into your credit card.

Air miles: You can opt for air miles, which you can use later to purchase flight tickets.

Donations: You can also choose to donate money to prominent charities using your reward points.

Different Types Of Credit Cards

The world of credit cards is a competitive industry with one bank having multiple types of credit cards, each equipped with unique features and benefits.

While at the basic level all credit cards have credit limits, usage of which attracts interest. However, the additional features can be very useful, based on your types of usage.

Depending on the type of benefit, a wide variety of credit cards are available at present. These are some of the common types:

Reward credit card: These types of credit cards earn you great reward points for specific kinds of transactions. The reward points can be redeemed for discounts, vouchers, products or even cashback on your credit card.

Shopping credit card: As the name suggests, these credit cards are tailor-made for a shopper. They earn discounts on shopping transactions. The bank/NBFC ties up with retail outlets to provide you discount vouchers and cashback.

Travel credit card: Are you an avid traveller? Then a travel credit card is ideal for you. You can enjoy discounts on airline ticket bookings, bus and rail ticket booking and much more! You can also enjoy complimentary access to international and domestic airport lounges. You also get air miles and extra reward points on all kinds of travel spending.

Fuel credit card: These cards provide offers and waivers on fuel expenses such as waiving off the fuel surcharge or extra rewards on purchase of fuel. You can make substantial savings on your fuel spending throughout the year.

Let’s see some of the best credit card offerings available as on December 2020:

How To Choose The Right Credit Card?

Previously we discussed that there are different types of credit cards available, each having unique features and benefits, but how to choose the right one for yourself. The wide range of credit card offers available can be quite daunting. So many options can make the task of choosing the right credit card for yourself quite difficult. Here are some of the things that you should consider while assessing different credit card offers.

Evaluate the features

Check out the features of the credit card and whether they match your spending type. For example, if you travel abroad often, you would want a card that has minimal foreign exchange fee, has frequent flier miles program and gives lounge access. On the other hand, if you shop online regularly, you would want a card which has great offers on online shopping. Check the reward points, cashback facilities, discounts and privileges to decide the right credit card for you.

Interest charges

This directly affects how much you pay back to the card issuer and hence should be a primary criterion. Some lenders charge higher interest than others. Some also offer lower interest in lieu of an annual fee.

Fees and charges

A very important aspect. If it is free for the first year, does it have any fees from second year onwards? Is it too high for you? What are the other charges? Evaluate the schedule of charges carefully.

Credit limit

What is your monthly spending? Is it high? Then you might want to choose a credit card with a higher credit limit and flexibility.

Ease of usage and payment

Finally, consider how easy it is to use the credit card and pay the bill. While most lenders offer online payment, still this is something to consider.

How To Apply For A Credit Card?

Now that we have learned to select the right credit card as per our requirements, we need to apply for it.

It is very easy to apply for a credit card. You simply need to follow these steps:

We have already discussed features and benefits. Now let us see the other aspects.

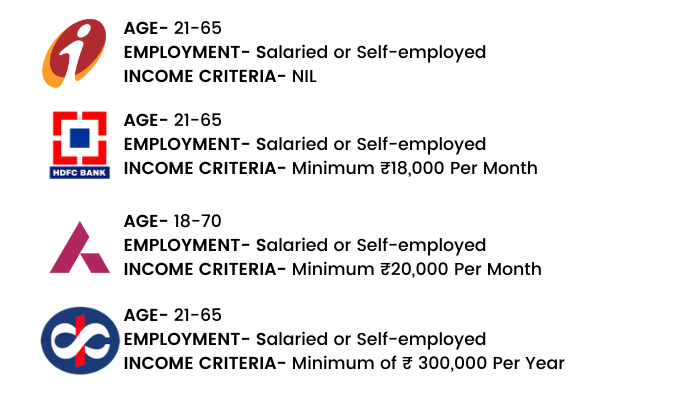

Eligibility criteria for obtaining a credit card:

Credit card is essentially an unsecured loan extended by the lender. Hence, it contains a risk on the side of the lender. Therefore, banks/NBFCs will establish your repayment power while approving a credit card. Things such as nature of employment, gross annual salary, Cibil score will be of primary importance.

Every bank/NBFC will have its own eligibility criteria for issuing a credit card. The most common factors affecting eligibility are:

Income: As mentioned earlier, income plays a very important role while applying for a credit card. The applicant must have a regular source of income so that he/she is able to repay the credit card bill.

Age of the applicant: Age plays a pivotal role as well since every individual has a steady source of income only for a certain period of years.

Credit history: Your credit history is the proof of your creditworthiness. It is easier to obtain a credit card with a good credit history. Here comes the role of Cibil score.

Cibil score is a 3-digit score ranging between 300 to 900 which is calculated based on a person’s credit repayment history. It takes into account all loans and credit cards taken by the person and has a history of all repayments made. This data is shared between all lenders in India. The higher the score, the better is the chance to obtain a credit card.

Additional eligibility criteria: Some banks/NBFCs may have additional eligibility criteria or they may waive off some criteria for their own customers. For example, Axis bank offers a credit card to anyone having a fixed deposit of ₹ 20,000 or above with them.

Now let us take a look at the eligibility criteria of some lenders as of December 2020. Of course, the actual eligibility criteria may vary during the time of applying for a credit card.

Documents required to apply for a credit card

A credit card application requires to be accompanied by simple documents which are:

- Identity proof: Aadhar card, PAN card, Passport, Voter’s ID card, Driving License, etc.

- Address proof: Aadhar card, Passport, Voter’s ID card, Driving License, rent/lease agreement, utility bills etc.

- Income proof: Salary slip (last 3 months), bank statement (last 3 months), ITR, etc.

However, the lender may request for additional documents if they need the same.

How To Use A Credit Card?

After applying for the credit card, once the application gets accepted you will receive the card. It is now time to learn how to properly use it.

To use the credit card, you will need either of the 2 things (sometimes both) – OTP and PIN. We have discussed OTP in section 2 of this module. Now let us talk about PIN.

Your credit card PIN is your secret code which you will use to authorize a transaction. In most cases, this can be generated online. Ensure that your PIN is not a predictable number such as your date of birth, anniversary etc.

The process of using a credit card is simple.

1. Using a credit card online

While using a credit card online, you will have to input your credit card number, the name of the card holder, expiry date and CVV. After this you will be sent an OTP (one-time password) through SMS. This is the secured number which you should never share with anyone else. You have to input this OTP, only after which the transaction will be successfully carried out.

Pro tip:

- While using the credit card online, ensure your phone is with you to access the OTP instantly.

- Never share the OTP with someone else.

- If you receive an OTP without making any transaction, contact your bank immediately. It can be a case of unauthorized transaction.

2. Using the credit card at a merchant outlet

When you visit a merchant outlet such as a retail shop, you will have to pay through a merchant point of sale machine. Earlier, the magnetic strip of the card had to be swiped for making payment. However, now, almost all cards contain a chip which makes the payment process much easier and secure. You need to insert the card into the machine. You will be prompted to input your credit card PIN to authorize the transaction. Once you input the PIN, the transaction will be successful.

Pro tip:

- Ensure that your credit card is with you at all times. Do not hand it over to another person and let them take it away for payment. Most credit card frauds happen this way.

- Cover your hand while inputting the credit card PIN and ensure no one is watching.

- Always collect the credit card slip and keep it for a few days till the transaction shows online on your credit card account.

Credit Card Payment

After spending from the credit card, a monthly bill is generated, which needs to be paid on or before the due date. Paying a credit card bill is quite simple. You can either pay online or through a cheque. You can save the credit card details in your net banking so that you can pay online seamlessly. Many banks will allow you to register the credit card under the section ‘biller’. However, the process may vary from one bank to another.

Alternatively, you can also decide to pay through a cheque and either deposit it in the bank or drop it in the designated drop boxes. Do not forget to write your name and mobile number on the backside of the cheque. This will help the bank to get in touch with you if there is a discrepancy in the cheque.

How To Increase Credit Card Limit?

Our income increases over time and so is our repayment capability. Our lifestyle also becomes better. So, over the years, our requirement for credit limit may increase and we can afford the higher limit as well.

Now the question is, how can the credit limit be increased?

Well, multiple options are available for this:

1. Request for an increased limit on your existing card: Your bank can increase your credit limit for you if you request for it. They will seek more information from you such as your updated salary slip or your latest income tax return. They will also look at your credit history and credit rating. However, please remember, this depends solely on the bank’s discretion.

2. Apply for a new credit card: This is an easy method. You can apply for a credit card with a different lender and choose from their credit card offering to suit your lifestyle needs. You may actually get a higher credit limit than your previous card. Plus, you may choose different cards to suit different needs – like one card can be a traveller card and another can be a rewards card.

3. Automatic annual increase: Some banks/NBFCs offer an automatic annual increase of credit limit if all the payments have been made on time. You can find out if this facility is being extended by your bank and opt for the same.

Master the A2Z of Finance in our beginner course! Start now to boost your credit card limit and financial knowledge

What is loan against credit cards

Yes, you can get a loan on your credit card. How? Let us see!

The loan is granted on the unused credit limit of the credit card. You can use it to finance your money requirements. The loan is issued with a nominal processing fee. You can pay back the loan through easy EMIs.

These loans are usually given for a shorter time period of less than 1-year or so. Some banks/NBFCs also offer an interest-free period.

The good thing about these loans is that they are hassle-free and require minimal paperwork since your details are already present with the bank. They are very convenient funding options for your short-term needs. However, be aware of the interest rate, it may be higher than other loan options available for you such as a personal loan or a gold loan.

Keeping Your Credit Card Safe

We often hear about the misuse of credit cards, don’t we? Fraudsters are finding new ways to dupe innocent users all the time.

So how do you protect your credit card from such frauds?

Here are a few things that you can do:

1. Keep your credit card with you at all times

The first and the most important thing to do is to keep your credit card safe. Most frauds happen when the card is stolen or misplaced. Keep the card in a safe place, and don’t carry it with you if you don’t need it.

As we mentioned before, in case you are swiping a card at a merchant outlet, don’t let it out of your sight. In case the swiping machine is kept somewhere else, accompany the shop personnel to ensure it is swiped in your presence.

2. Keep your PIN safe

This goes hand in hand with our first tip. Keep your PIN safe at all times. Here are a few things you can do in this regard:

- Don’t share it with anyone else.

- Don’t keep an easily guessable PIN such as your date of birth or your anniversary.

- Don’t write it down anywhere.

- Change your PINat least once in 6 months.

3. Check monthly credit card alerts regularly

Your bank must be sending SMS/email alerts for all transactions done by you. Keep a tab on them and check them often. In case you receive an alert but you have not done any transaction, immediately contact your bank and inform them.

4. Manage your online activity

Do not click on unknown links or open unknown websites either on your laptop or on your tab or mobile. Most bugs enter a device this way. If you are not sure about the origin of a link, it is advisable to not open the same. If you receive any suspicious message or email, delete it immediately. Ensure that it is not lying in your trash folder as well. Check the trash folder and delete it from there too.

5. Inform the bank immediately if your card is lost or stolen

Finally, we come to the most important tips of all. In case you feel that your card has been lost or stolen, call your bank immediately. In case unauthorized transactions have already taken place in your card, inform them about that as well.

What to do if your credit card is stolen/lost?

In case your credit card is lost or stolen, you need to do these things immediately:

1. Call your credit card issuer: Call your credit card issuer and inform them about the lost card. You can find your credit card issuer’s phone number in your credit card statement or online.

2. Provide your information: Your credit card customer care representative will first ask for verification to establish that you are the owner of the card. Then they will block your credit card immediately and issue you a new credit card.

3. Keep a record of the conversation: During the conversation, the customer care representative may give you a service reference number for your request. Write it down somewhere. This will help you follow up on your request in future.

Finally, don’t panic. Every bank/NBFC has a certain insured amount for credit cards which they can refund to your credit card. However, this remains solely in the discretion of the issuer. This amount will be written in the terms and conditions statement sent to you while issuing the credit card. You can check this beforehand to be aware of all the aspects of your credit card.

Conclusion:

We are not at the end of this module. Though we have learned a lot about Credit Cards and its uses. We hope next time you apply for credit cards or purchase any goods or services on credit cards, these lessons will definitely help you. If you like this module please share it with your friends and family. There are also many such interesting modules on ELM School. You can read them all and increase your knowledge in the world of finance.

Happy learning!